What is a Hard Money Home Equity Loan?

A hard money home equity loan is a short-term loan provided by private lenders or small lending firms.

Unlike traditional loans, which assess the borrower’s creditworthiness and financial history, these hard money second mortgage loans are based almost entirely on the value of the collateral—in this case, the home equity.

Key Features:

- Short repayment terms, typically 6 months to 3 years.

- High interest rates ranging from 8% to 15%.

- Quick approval and funding, often within days.

- Minimal emphasis on credit score or income verification.

This type of hard money loan is particularly attractive for borrowers needing rapid funding for specific purposes, such as real estate investments, home renovations, or addressing urgent financial obligations.

Case Study: A Real Estate Investor’s Success with a Hard Money Equity Loan

Michael, an experienced real estate investor, identified a foreclosed property in a prime location in Florida selling well below market value. His goal was to purchase, renovate, and resell for a profit, but a tight timeline meant he couldn’t wait for traditional bank financing.

Michael used a hard money 2nd-mortgage, securing $150,000 within 10 days by leveraging his primary residence. This allowed him to quickly acquire the property, renovate it within four months, and sell it for a $50,000 profit—a deal that would have been impossible without fast financing.

In 2025, hard money Florida loan programs continue to be a valuable financing tool for those who need fast access to capital, have credit or income challenges, or want to invest in non-traditional properties. While interest rates are generally higher with the hard money equity loan than traditional 2nd mortgages, the speed, flexibility, and accessibility make them a powerful option for homeowners and investors looking to leverage their real estate assets for financial gain.

What is a Non-QM HELOC Loan?

A Non-QM HELOC, on the other hand, is a flexible line of credit secured by your home equity. Unlike a conventional home equity line of credit, Non-QM HELOCs cater to borrowers with unique financial situations, such as self-employed individuals, retirees, or those with nontraditional income sources. This is not a hard money non QM loan. The non QM HELOC typically has lower interest rates and more favorable terms than the hard money HELOC.

- Key Features:

- Adjustable credit limits based on the property’s equity.

- Interest-only payment options during the draw period (typically 10 years).

- Longer repayment periods, often up to 30 years.

- Uses alternative documentation, such as bank statements or asset-based income verification.

A Non-QM HELOC is ideal for homeowners seeking ongoing access to funds for recurring expenses, renovations, or investments.

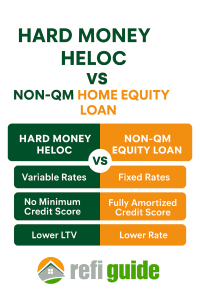

Comparing Hard Money Loans and Non-QM HELOCs

Speed vs. Flexibility

Hard money loans are all about speed—fast approval, quick funding, and minimal documentation. They’re the financial equivalent of a sprinter, ready to dash when urgency calls. However, this speed comes at a price, namely high interest rates and short repayment periods.

In contrast, Non-QM HELOCs are more like marathon runners, built for endurance and flexibility. They provide access to funds over a longer period, offering borrowers the ability to draw as needed and pay interest only during the draw period.

Cost vs. Convenience

The cost of borrowing is higher with hard money loans, as lenders assume greater risk by focusing on the collateral rather than the borrower’s creditworthiness. Interest rates can be as high as 15%, and fees, including origination fees, can be significant.

Compare Quotes from Competitive Hard Money and Non QM Lenders Online

Non-QM HELOCs, while still carrying higher rates than traditional HELOCs, are generally more affordable than hard money loans. Their convenience lies in the revolving credit structure, which allows you to borrow only what you need, reducing unnecessary costs.

When to Choose a Hard Money Loan

Let’s help illustrate when hard money loans tend to shine. Imagine you’re an investor trying to flip a property—it’s like needing a fire extinguisher to quickly put out a financial fire. Hard money loans are perfect for situations where time is of the essence, such as:

- Securing funding for a real estate purchase before a competitor snatches the deal.

- Addressing urgent financial needs where traditional loan approval takes too long.

- Funding high-risk projects where traditional lenders refuse to lend.

Hard money loans act as the financial cavalry, charging in to save the day, albeit at a high cost.

When to Choose a Non-QM HELOC

Non-QM HELOCs are like a toolbox, equipped with the financial tools you need for a variety of tasks. They are ideal for:

- Self-Employed Borrowers: Those with irregular or nontraditional income sources can qualify without needing W-2s.

- Homeowners Seeking Flexibility: If you want to fund renovations or recurring expenses over time, a Non-QM HELOC allows you to borrow as needed.

- Real Estate Investors: Ideal for investors who need access to funds for multiple projects but prefer a revolving credit structure over lump-sum loans.

6. Risks and Drawbacks (Parallelism)

Both hard money loans and Non-QM HELOCs come with risks that must be carefully considered:

- Hard Money Home Equity Loans:

- High interest rates can make repayment expensive.

- Short repayment periods increase the risk of default.

- If you fail to repay, you could lose your home to foreclosure.

- Non-QM HELOCs:

- Variable interest rates can rise significantly, increasing costs.

- If you use the funds irresponsibly, you may face long-term financial strain.

- Draw period expiration requires repayment, potentially leading to a financial crunch.

Real-World Scenarios

Hard Money Loan Example

A real estate investor finds a distressed property priced below market value. The property needs extensive repairs, and traditional lenders won’t approve a loan due to the property’s condition. The investor secures a hard money loan to purchase and renovate the property. Once the renovations are complete, the investor sells the property at a profit, repaying the loan in full.

Non-QM HELOC Example

A self-employed entrepreneur with substantial home equity wants to fund a startup. Traditional lenders deny a loan due to inconsistent income, but a Non-QM HELOC provides the needed flexibility. The entrepreneur draws funds as necessary, covering startup costs without the burden of a lump-sum loan.

Choosing the Right Home Equity Loan Option

Which option is right for you?

The answer lies in your financial situation and goals. Do you need immediate funding for a short-term project?

A hard money loan may be the answer. Are you looking for ongoing access to funds with flexible repayment options?

A Non-QM HELOC might be the better fit.

Hard money home equity loans and Non-QM HELOCs each serve distinct purposes, making them valuable tools in the financial toolkit.

While hard money loans provide quick access to funds for high-risk or urgent projects, Non-QM HELOCs offer flexibility and convenience for homeowners with unique financial circumstances.

When choosing between the two, consider your specific needs, financial stability, and long-term goals.

By aligning the loan type with your objectives, you can leverage your home equity effectively while minimizing risks.

Top 5 Reasons to Get a Hard Money Equity Loan

A hard money home equity loan is an alternative financing option that leverages the equity in your property as collateral. Offered by private lenders, these hard money second mortgage loans are designed to provide fast, flexible funding for borrowers who may not qualify for traditional loans due to credit challenges, time constraints, or unconventional needs. While they often come with higher interest rates, hard money loans serve specific purposes that make them invaluable in certain situations. Here are the top five reasons to consider a hard money equity loan.

1. Quick Access to Funds

One of the primary benefits of a hard money equity loan is the speed of approval and funding. Traditional lenders often require extensive documentation and weeks, if not months, to process applications. Hard money lenders for home equity loans focus on the value of the property rather than the borrower’s creditworthiness, enabling faster decision-making and funding, often within days.

- Why It Matters: For borrowers facing urgent financial needs—such as covering emergency expenses, seizing a real estate opportunity, or resolving a time-sensitive issue—quick access to funds can be a game-changer.

2. Ideal for Real Estate Investments

Hard money loans are a favorite among real estate investors, particularly those involved in fix-and-flip projects or short-term investments. These loans are tailored for scenarios where properties require renovations before they can be sold or refinanced at a higher value.

- Why It Matters: Traditional lenders often avoid financing distressed properties or those in need of repairs. A hard money 2nd mortgage allows investors to purchase and renovate these properties, enhancing their market value. Once the project is complete, the loan can be repaid through the property’s sale or a refinance.

3. Less Emphasis on Credit Scores

- Why It Matters: Borrowers who have faced financial setbacks or are self-employed often struggle to meet conventional loan requirements. A hard money equity loan provides an opportunity to access financing based on their property’s equity rather than their credit score.

4. Flexible Home Equity Loan Terms

Hard money lenders offer greater flexibility in structuring loan terms compared to traditional lenders. Borrowers can negotiate repayment schedules, loan-to-value (LTV) ratios, and even interest rates in some cases. This customization ensures that the loan aligns with the borrower’s unique financial situation and project goals.

- Why It Matters: Flexibility is crucial for borrowers undertaking nontraditional projects or facing unique financial circumstances. The ability to tailor loan terms can make repayment more manageable and reduce financial strain.

5. High Loan-to-Value (LTV) Ratios

While most traditional lenders cap LTV ratios at around 80%, hard money lenders often allow higher LTV ratios, sometimes up to 85% or more, depending on the property’s value and the borrower’s financial situation.

- Why It Matters: Higher LTV ratios mean borrowers can access more funds from their property’s equity, which can be particularly useful for large-scale projects or consolidating significant debts.

Things to Consider Before Getting Hard Money Equity Loans

While hard money home equity loans offer unique advantages, they come with higher interest rates, shorter repayment terms (typically 6 months to 3 years), and fees such as origination costs. Borrowers should carefully evaluate their ability to repay the loan within the specified timeframe to avoid the risk of foreclosure. The hard money loan second mortgage continues to be one of the most requested equity loan programs this year.

Hard money equity loans are a powerful financing tool for borrowers who need fast, flexible funding and are willing to leverage their property’s equity. Whether you’re a real estate investor, a borrower with credit challenges, or someone facing urgent financial needs, these loans provide a viable solution when traditional options fall short. By understanding the benefits and risks, you can make informed decisions and use hard money loan second mortgage products effectively to achieve your financial goals. Always consult with a trusted financial advisor or lender to determine if a hard money loan is right for you.

Posted On March 17, 2025 in Home Equity

Get Mortgage Loan Offers Customized For You Today

About RefiGuide

Bryan Dornan is a financial journalist and currently serves as Chief Editor of RefiGuide.org. Bryan has founded several mortgage and marketing companies and has worked as a loan officer and mortgage broker in the industry for over 25 years and has a wealth of experience in providing mortgage clients with the highest level of service in the industry. Bryan's continual focus is to promote affordable home-ownership to consumers like you across the United States. He also writes for RealtyTimes, Patch, Buzzfeed, Medium and other national publications. Find him on Twitter, Muckrack, and Linkedin

More articles by RefiGuide