Many people in the Houston, Texas area are most likely going to have difficulty in paying their mortgages in the months to come. There are thousands of homes flooded facing huge damage costs, and many people in the flooded areas were not required to have flood insurance. Plus, even people with homes that were not seriously damaged are facing difficulties in getting to work. So, there could be tens of thousands of families that could have great problems in keeping up with mortgage payments.

See Texas Mortgage Relief Programs for Harvey Victims

Millions need help and top housing agencies are voicing support.

The loan forbearance could last for 90 days in some cases, and may be extended to a year in other cases. Texas loan forbearance means that the borrowers will not have to pay a monthly payment on their mortgage for that period. There will be no penalty charged on the loan, but interest will accrue as normal.

Housing finance experts say that the move by Fannie, Freddie and FHA is a temporary but welcome Band-Aid that helps home owners and the US government. After all, it is not in the interest of the US government to have thousands of home owners foreclosed upon by their lenders. This means that the US government will have to reimburse the lenders for most of the cost of those loans.

HUD considers Texas Mortgage Relief for Harvey Victims

It is hard to know for sure what people in Houston will be facing when all of the floodwaters go away. Some home may be able to be dried out and saved. And some homes will likely be a total loss. The best way to get an idea of how many homes could be affected in terms of payments and forbearance is to look at what happened with Hurricane Katrina in 2005.

There were thousands of homes damaged and destroyed with Hurricane Katrina. But reports in Houston suggest that there are twice as many mortgaged properties in Houston with four times the unpaid loan balance of what there were in Louisiana and Mississippi in 2005 that were affected by that storm. If the effects in Houston are similar, there could be 75,000 home owners in the city who are not able to make loan payments for the next two months at least. There could be 45,000 more that could be unable to make loan payments in the next four months.

Whether people are going to continue to pay on their Fannie, Freddie or FHA backed home loan will often come down to the type of homeowner’s and flood insurance they have, if any.

FEMA will have limits and caps in place for how much they will reimburse homeowners. Houston is not really in a traditional flood plain. It comes down to whatever the policy coverage included. Many insurance policies will probably only cover 25% of the replacement cost.

Borrowers in the Houston market have more equity available in their homes than people in Katrina did in 2005, because more people back then were using low and 100% financing loans. Today’s mortgage loan market is stricter, and borrowers usually have to bring a larger down payment. The minimum down payment for FHA loan mortgages for example is 3.5%. There are also 3% and 5% down loans available with some Fannie and Freddie programs. Many other buyers in the Houston area put down 10-20% and more.

In 2005, 20% of borrowers in Katrina affected areas had 10% or less equity. In Houston, that is only 4% of the market, so there could be more incentive for these home owners to use loan forbearance temporarily and stay in the home.

Experts in the insurance industry say that it is hard to predict what home owners will do until most of the damage has been surveyed and categorized. It is unclear at this time whether the damages will be said to be due to flood, a natural disaster or an act of God. It also depends upon how the water affected the home. If water comes in through the foundation, the home damage will be covered differently than if wind damaged a window and water entered the home that way.

The Department of Housing and Urban Development is going to offer some recovery loan options for people in the Houston area who have trouble making their loan payments. Also, there may be funding made available through the Community Development Block Grant Program. It remains to be seen how quickly those funds will be made available; they tend to be given to states and municipalities that then establish their own standards for who qualifies for assistance.

There is no doubt however that government mortgage loans and forbearance programs by FHA, Fannie Mae and Freddie Mac will provide welcome if temporary relief for many home owners in the Houston area.

Fannie Mae and Freddie Mac Announces Relief Programs for Victims

Forbearance can help homeowners in financial trouble to avoid foreclosure. It can be either a temporary halt or reduction in payment that allows the borrower to work through a tough financial situation such as a flood.

Other home owners may be eligible for forbearance if they have a sudden job loss or a death or illness in the family. Freddie Mac announces new mortgage assistance for Hurricane Harvey victims.

Hurricane Harvey Victims Granted Temporary Relief from Foreclosure

If you think you need a loan forbearance, you should talk to your lender. With FHA loans, you would need to apply for FHA’s forbearance program. Your lender will review your payment history to see if you are eligible. You will need to gather various documentation such as your pay stubs and tax returns. You also have to show why you are not able to afford your loan payments at this time.

Also, home owners need to show that their finances are going to improve in the future. If it looks as if you are not going to be able to make payments after the forbearance period is up, the lender may still foreclose.

New Texas Mortgage Relief Programs for Harvey Victims

Do you live in Texas and were affected by Hurricane Harvey?

You may be able to get a break from your lender on your mortgage temporarily.

Many lenders are giving mortgage holders a break after their homes were devastated in Texas by Hurricane Harvey.

Some of the lenders are allowing mortgage holders to stop mortgage payments temporarily, stop foreclosures, or offer special financing terms to help with rebuilding homes.

If you are interested getting forbearance on your mortgage due to Hurricane Harvey, here are some easy steps to follow:

Talk to Your Mortgage Lender Directly

It may take longer than clicking a link online, but experts advise that the best way to get mortgage relief in Texas in the aftermath of Hurricane Harvey is to get on the phone to your lender.

Before you make the call, collect as much information about your post-hurricane financial situation as you can. It is important to provide your lender with as much information as you can. Your lender will want to know how much mortgage payment assistance you need and what you can afford to pay as you are cleaning up in the coming months. This will help the lender to determine what kind of help you can get. It also will avoid you taking on more debt than you need.

Experts also advise that you go to the home page online of your lender to see if there has been any announcement about Hurricane Harvey relief.

Harvey Victim Homeowners Had More Equity than Irma’s Had

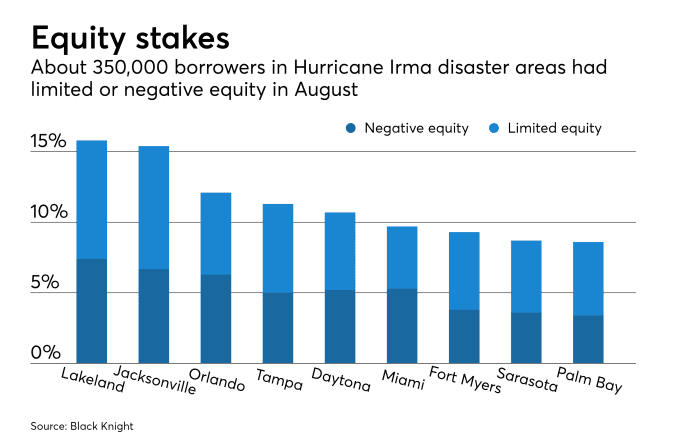

One positive note for some of the Texas hurricane victims is that according to the Black Knight Financial Services, “a majority of borrowers impacted by Hurricane Harvey have a significant amount of equity, while about 350,000 in Hurricane Irma disaster areas have either limited or negative equity.”

National Mortgage News published an article revealing insight from Black Night, “Of the 3.2 million borrowers impacted by Irma, an estimated 170,000 were still in negative equity positions before the storm, with another 180,000 having less than 10% equity in their homes,” said Graboske.

“Due to lackluster house price recovery since the real-estate crisis, the negative equity rate in Irma’s disaster area is nearly twice the national average.”

Know What Your Options Are

If you have a government-backed mortgage as most home owners do, you may be able to apply for a mortgage loan forbearance period if you were affected by Hurricane Harvey in Texas.

What this means is that the lender may delay payments for up to 12 months. This is common with loans that are backed by FHA, Fannie Mae and Freddie Mac. You will not typically incur any late fees or have any delinquencies reported to your credit report for the later payments.

FHA lien holders in particular are eligible in Hurricane Harvey affected areas for forbearance, loan modification or 90-day foreclosure delay.

Some lenders including Quicken Loans are also taking off late charges and freezing reporting of delinquent payments for homeowners who suffered damages from Hurricane Harvey.

Some home owners in Texas are getting forbearance on their mortgage and using those funds to pay for home repairs.

How to Help Victims

Please Donate what You Can…

The vast majority of mortgage lenders offer loans that are guaranteed by Fannie Mae and Freddie Mac. So, your loan is probably eligible for various relief programs if you live in an area that was declared a disaster area by FEMA. This would apply to people affected by Hurricane Harvey and Irma in 2017.

If your lender is not clearly offering forbearance or other financial options, experts advise you to visit the website of the Federal Housing Finance Agency or the US Department of Housing and Urban Development. You can check at those sites for the type of help you may be able to get. Also, you can use these sites to locate the name of the lender who currently owns your mortgage.

Be Aware of What You Are Signing Up For

A lender may provide you with mortgage relief or help after Hurricane Harvey. But this does not mean it will forgive any debt that you owe. Even with a forbearance offered by the US government, you are only deferring that amount to be paid later on.

It is important to be wary of people who say they are offering mortgage relief from any government agency. You should be suspicious any time you receive a phone call or email that offers this type of help. You also should never be asked from a legitimate government authority for any fees up front for any service provided.

Check Your Options Before You Sign Up

Some Texas lenders are offering storm relief financial products that are separate from government programs. These products are being offered to help with home repairs. But you need to understand if the product is a loan against your home’s equity, a personal loan, or a home equity credit line.

A personal loan can sometimes be the best way to get fast cash to fix your home. This is often the case when you are waiting for the insurance company to send you a check, or are waiting for a check from FEMA.

The Bottom Line on Hurricane Harvey Mortgage Relief

If you were hit hard by Hurricane Harvey in Texas, there is plenty of help available from the US government. You need to understand if your home loan is backed by Fannie Mae, Freddie Mac or FHA. Once you understand that, you can then apply for various types of government assistance. If you don’t know who backs your home loan, check with your mortgage lender or broker. They can tell you who guarantees your loan.

References:

- Harvey Hits Mortgages as Floods Stricken Homeowners Unlikely to Pay. (n.d.).

- Hurricane Victims Can Get a Break on Mortgage Payments. (n.d.).

- Fannie Mae Offers Relief Options for Homeowners and Servicers in Areas Impacted by Hurricanes Harvey & Irma

- Harvey-impacted borrowers have healthier equity than those of Irma

- Black Knight’s August Mortgage Monitor