Many home buyers are wondering if private mortgage insurance or PMI was still tax deductible. With all of the media publishing articles about the tax reform, it is imperative that you get the facts on tax deductions for PMI before committing to a home loan in the new year. As interest rates continue to spike it has become imperative for home buyers to deduct the private mortgage insurance to offset the increased housing expenses.

Is mortgage insurance tax deductible? The good news is that mortgage insurance, also known as, PMI can still be deducted for tax purposes, but keep reading to understand all the details and new laws on PMI and tax deductions for homeowners this year. PMI is not always tax deductible this year as, there are certain requirements that must be met. So, to write-off mortgage insurance premiums the qualification must be met and then the itemized deduction must be documented on your return.

For many homeowners, the tax implications of their mortgage interest and home financing costs are a critical aspect of leveraging the financial situation. PMI is a common requirement for those borrowers making a minimal down-payment. In most cases, when a consumer gets a home loan with down payment of less than 20% on their home purchase, the lending company will require private mortgage insurance to be paid monthly in an effort to minimize the risk of default. One of the most common questions is whether PMI is tax-deductible.

When you think about the many costs that are associated with buying a home, such as the down payment, closing costs, appraisal fees, legal fees, moving costs and so on, it is not something that you take lightly. And if you got a home loan that was 80% or more of the purchase price, you also probably had to buy private mortgage insurance or PMI, as well.

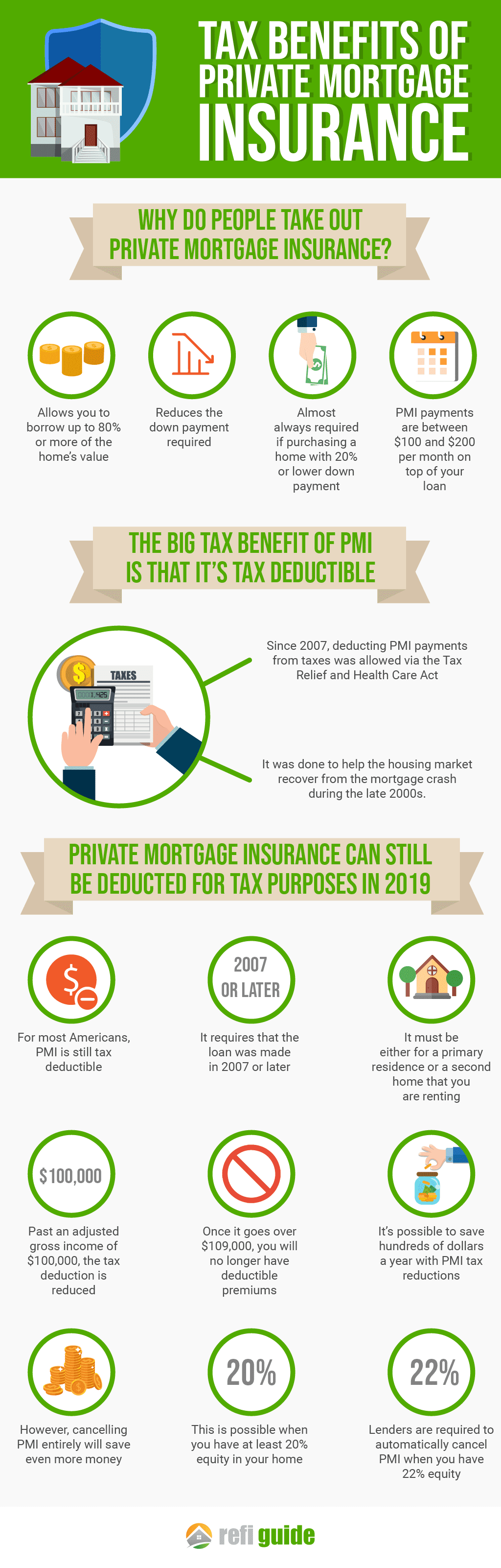

PMI is the reason that brokers and lenders are willing to take a risk on lending you 80% or more of a home’s value. It protects the mortgage lender if you cannot make your payments and default on the loan. If you do default on the loan, the lender is paid back part of the mortgage principal. This is done so that more lenders are willing and able to lend money to people without very large down payments.

Your PMI payment is usually as part of your monthly mortgage payment. It is typically an extra $100 or $200 per month on top of your loan, depending upon the value of the home, your personal credit and other factors.

While many people do not like the idea of PMI, it is worth remembering that private mortgage insurance is the ‘price’ you pay for being able to get a home loan with 20% or less down. Without PMI, most buyers would need to come to the table with 30%, 40% or 50% of the home’s value; this is beyond the means of most Americans.

But there is one big benefit to PMI that you may not be aware of: It is tax deductible for many Americans. This goes back to 2007, when deducting your PMI payments from your taxes was allowed via the Tax Relief and Health Care Act. It was applied to PMI insurance policies that year for most homeowners, and has continued ever since. It was done in part to help the housing market to recover from the mortgage crash of a decade ago.

Can I Deduct PMI or MIP (mortgage insurance premium) for Tax Purposes?

According to Turbo Tax, the mortgage insurance deduction began in 2006 and was extended by the Protecting American from Tax Hikes Act of 2015.

For most Americans today, PMI is tax deductible. It is required that the loan was made in 2007 or later, and it has to be either for a primary residence or a second home that you are not renting out. Congress recently passed a bill amending the rules for tax deductions and private mortgage insurance. Read about the Mortgage Insurance Tax Deduction Act of 2017.

Also, your adjusted gross income cannot go over $109,000. Once your income rises to this level, the PMI deduction begins to be phased out at $100,000 AGI and higher. It is totally removed once you go over $109,000 per year AGI. If your AGI is in the range of $100k to $109k, you should use the worksheet that is with Schedule A of your income tax form to determine the level that can be deducted from your federal tax obligation. Remember that borrowers with less than $100,000 AGI can deduct all of their PMI expenses.

The PMI tax deduction works for home purchases and for refinances. Depending upon the level of your adjusted gross income, you may be able to deduct mortgage insurance for FHA and USDA loans as well. It’s no wonder why we are receiving so many emails asking whether mortgage insurance and PMI is tax deductible in 2024.

Learn How to Get Rid of Mortgage Insurance in 2024

Since PMI used to tax deductible, you have another reason to refinance out of the home loans and into a No PMI mortgage. It makes sense to see if you can qualify for a mortgage with a lower interest mortgage without paying PMI. Find out if closing costs are tax deductible on a mortgage refinance this year.

To claim your deduction on your taxes, you have to itemize your personal deductions on Schedule A; this is included with the IRS form 1040. If you prepay any amount of your PMI, you may not deduct all of your prepayments in the year that you paid. You have to wait to make your PMI deduction in the tax year that the premium covers.

Note that the PMI tax deduction is not always permanent anymore. It has to be renewed by Congress every year. As of 2021, the tax break is still in effect. It appears that Congress in 2017 has renewed the PMI tax deduction for 2024. But people who are buying homes in the future should always check with their CPA to determine if the PMI tax deduction is still in effect. According to the Department of Housing and Urban Development, all loans before June 3 2013 once the LTV reaches 78% and mortgage insurance has been paid at least 5 years the insurance can be cancelled. However, all FHA mortgages that closed after June 3, 2013 have to pay mortgage insurance for life of the loan.

This has been the only major tax break for homeowners that can potentially be cancelled by Congress. The deductions for mortgage interest are safe for now up to at least $500,000 homes, and this could be $1 million, depending upon tax reform that is being debated on Capitol Hill at the end of 2019. Real estate tax deductions are safe for most homeowners, but the current tax reform bill may end up canceling the real estate tax deduction for amounts over $10,000 per year.

Remember to Check Your Home Value Yearly

If you have PMI, you should remember to check roughly what your home is worth every year, as well as home much equity you have in the home. You will not need to pay for PMI anymore once you have 20% of equity in the property. The only exception to that is recent FHA loans; if you put 3.5% down, you cannot cancel PMI. FHA loans with at least 10% down can cancel PMI after 11 years. (How is mortgage insurance calculated?)

For others, you should verify if you have hit at least 20% equity in your home. It would be unusual for a mortgage lender to voluntarily cancel your PMI. You will generally need to check on it yourself and request in writing that PMI be cancelled.

To get a current value, the best way is to have an appraisal done; this is the most accurate way to gauge value. Failing that, you can check online to get an idea of what similar homes are worth in your area. Once you are confident that you have 20% equity, you should talk to your lender to get rid of that PMI payment.

How to Cancel PMI (Private Mortgage Insurance)

There is no telling when Congress will extend or revoke the mortgage insurance tax deduction. It can pay off to check your mortgage balance and compare it to your home’s fair market value. You will not have to pay for mortgage insurance anymore when equity in the home is more than 20%. But your lender probably will not point this out; if you want to pay for mortgage insurance you don’t need, they probably will be pleased to let you do so.

When you have 20% equity in the home, you should be able to get the PMI cancelled by written request. You may need to have the home appraised or have a value otherwise assigned to it by a real estate professional. Even if Congress decides down the road not to extend this tax deduction, you still can save money by dropping PMI on your own when you have 20% equity. However, if you have an FHA mortgage, things get more complicated. If your loan was issued after June 2013, you may have to pay for mortgage insurance for the life of the loan, UNLESS you put down 10% or more. In that case, you probably can cancel mortgage insurance after 11 years.

Mortgage insurance can be annoying, but a lot of people can tax deduct the expense and can cancel it after they hit 20% equity. If you are tired of paying mortgage insurance, consider programs that include lender paid PMI, as there may be no-PMI mortgage options available that would not require paying monthly PMI even with no equity.

Updated Info on Private Mortgage Insurance Deductions

In 2024, private mortgage insurance is no longer tax deductible. In the past, the tax deductibility of PMI was possible but subject to specific conditions. In the past, PMI were tax-deductible and paying private mortgage insurance often provided a financial benefit to homeowners who were paying PMI monthly. However, according to the IRS, the PMI deductibility is not a permanent guaranteed benefit and was subject to legislative extensions from Congress.

The PMI deductibility of PMI was included in a legislative package of tax provisions known as “extenders” that Congress periodically extended, typically on a short-term basis. The extensions included the deduction for PMI but are not considered permanent as they were subject to renewal or expiration. This has creating uncertainty for homebuyers considering mortgages that required private mortgage insurance.

A few years ago, to benefit from the PMI tax deduction, specific criteria must be met. In most instances, homeowners needed to meet income limitations, and the home mortgage had to be closed after 2006. Additionally, the PMI tax deduction was phased out for higher-income taxpayers.

It’s crucial for homeowners to stay informed about changes in tax laws, as the deductibility of PMI premiums could be impacted by legislative updates. As you know, Tax laws are subject to revisions, and homeowners should consult trusted tax advisers or the latest Internal Revenue Service (IRS) guidelines for the most accurate and up-to-date information.

While in the past, PMI deductibility was an attractive tax benefit for some homeowners, it’s important to note that the deduction was not available for all types of mortgage insurance. For example, premiums for government-backed mortgage insurance, such as those associated with FHA loans, were not typically eligible for this deduction.

When PMI premiums are tax-deductible, homeowners can claim the deduction on Schedule A of their federal income tax return. However, it’s essential to weigh the potential tax benefit against the overall cost of PMI. For many homeowners, the goal is to reach a point where they can eliminate PMI altogether. This can be achieved by reaching a loan-to-value (LTV) ratio of 80%, either through home value appreciation, paying down the mortgage, or a combination of both.

The deductibility of PMI premiums was not a permanent feature of the tax code, and homeowners were advised to stay informed about changes in tax laws. Consulting with tax professionals and staying abreast of the latest IRS guidelines are crucial steps in maximizing potential tax benefits associated with homeownership.

In summarizing, the tax deduction benefits of (PMI)Private Mortgage Insurance premiums were key features, but they are subject to periodic extensions and conditions. Maybe in 2024 or 2025, Congress will revert back to previous extensions that enable homeowners that meet the specific criteria to potentially deduct PMI premiums on their federal income tax return. However, given the nature of tax laws, it’s always critical for homeowners to update themselves about current legislative changes and always consult with trusted tax consultant for accurate and relevant guidance on the deductibility of PMI premiums.

References:

- Is Private Mortgage Insurance Deductible? Retrieved from When Is Insurance Tax Deductible? (investopedia.com)

- Is My PMI Insurance Tax Deductible?