The terms “affordability” and “ultra-luxury housing market” may not immediately seem like they go together, but the truth is that as the U.S. housing market continues its recovery and median sales prices keep trending upward, more and more cities and towns across the country, even some not necessarily considered elite enclaves, will likely see their housing values keep rising.

Even today, many housing markets in which the median sales price is over $1 million also boast household incomes that make buying or renting in those neighborhoods more realistic than one might imagine. Take, for instance, Boca Grande, a small upscale village in Florida where the median home sales price went up 13.2% between 2018 and 2019. Even after paying an annual rent amount of more than $20,000, the average Boca Grande household has nearly two-thirds of its annual incoming remaining.

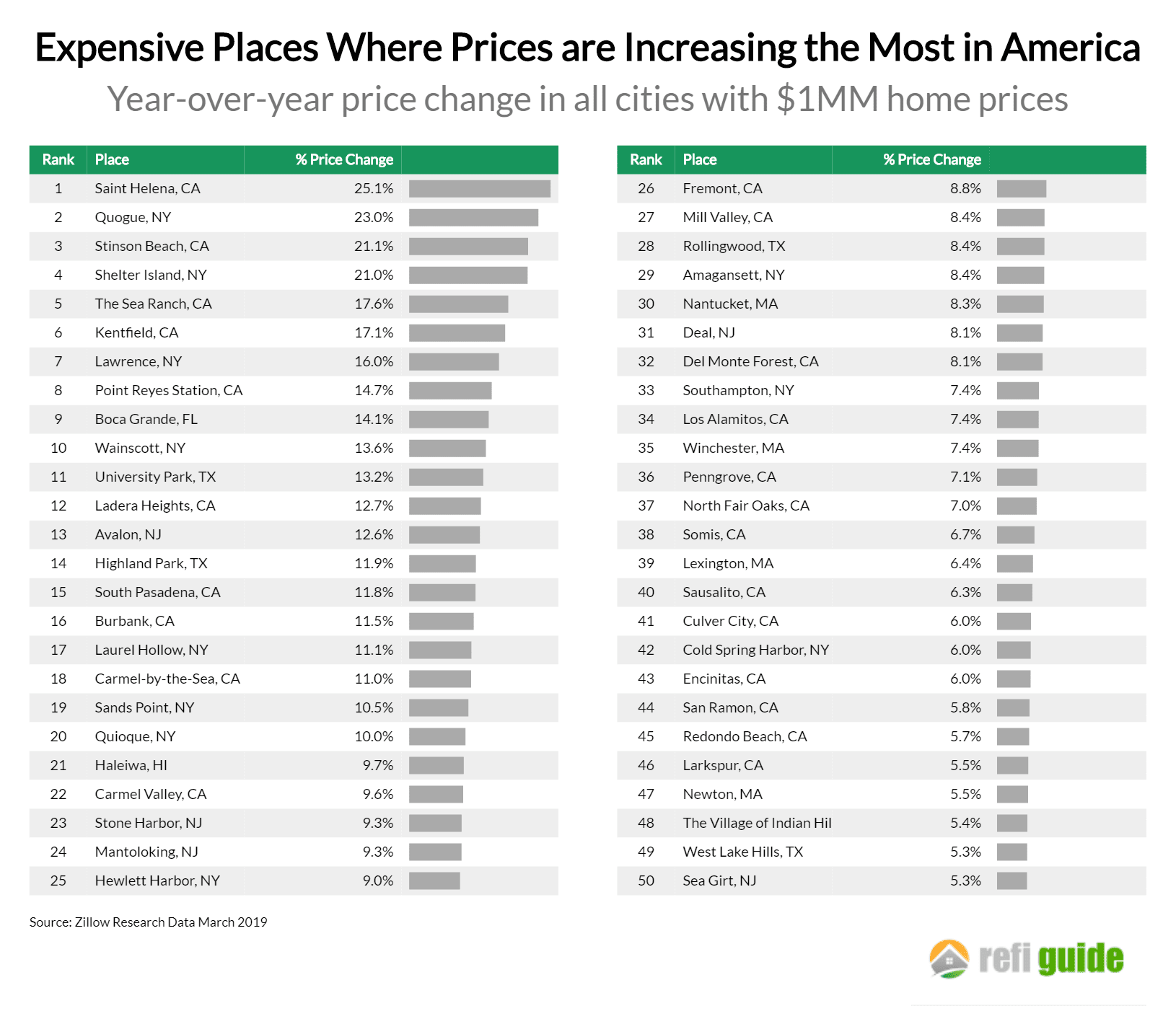

At RefiGuide.org, we wanted to dig deeper into the 50 communities we identified earlier this year as especially hot luxury markets, or those with home values over $1 million in which prices are rising the most. We wanted to see how affordable those markets are for the average resident, so we looked at the annual median household income for zip codes in each city, village or town, which we got from the U.S. Census Bureau, and rental data from Zillow Research (median 3-bedroom monthly rent for zip codes, cities or counties, depending on the community).

Check out how all 50 hot million-dollar housing markets performed in the table below and read on to see even more details about the 25 markets we think are most affordable.

Here’s a quick summary of what we learned:

- In 8 markets, rent will eat up more than the annual median household income, and 7 of the 8 are in New York.

- The least affordable community is Wainscott, NY, where the median income is nearly $72,000, and the average annual rent is more than a quarter of a million dollars.

- 4 of the top 10 most affordable communities are in New Jersey, 2 are in Massachusetts, and 2 are in Texas.

- Of communities where any income is left after annual rent, the median percentage is 62.1%

- The median annual household income of the locales on this list is $98,789.

Top 25 Most Affordable Million Dollar Housing Markets

Here’s our list of the 25 most affordable million-dollar housing markets with large price increases, based on median annual income and median rent for a 3-bedroom place.

#25 Deal, NJ

- Percentage increase in median home sales price: 8.1%

- Annual median household income: $77,778

- Median monthly rent amount: $2,600

- Income remaining after annual rent: $46,578

- Percentage of income remaining after annual rent: 59.9%

#24 Los Alamitos, CA

- Percentage increase in median home sales price: 7.4%

- Annual median household income: $97,598

- Median monthly rent amount: $3,250

- Income remaining after annual rent: $58,598

- Percentage of income remaining after annual rent: 60.0%

#23 Carmel Valley, CA

- Percentage increase in median home sales price: 9.6%

- Annual median household income: $96,458

- Median monthly rent amount: $3,150

- Income remaining after annual rent: $58,658

- Percentage of income remaining after annual rent: 60.8%

#22 North Fair Oaks, CA

- Percentage increase in median home sales price: 7.0%

- Annual median household income: $139,833

- Median monthly rent amount: $4,500

- Income remaining after annual rent: $85,833

- Percentage of income remaining after annual rent: 61.4%

#21 Somis, CA

- Percentage increase in median home sales price: 6.7%

- Annual median household income: $92,417

- Median monthly rent amount: $2,874

- Income remaining after annual rent: $57,929

- Percentage of income remaining after annual rent: 62.7%

#20 Penngrove, CA

- Percentage increase in median home sales price: 7.1%

- Annual median household income: $95,272

- Median monthly rent amount: $2,891

- Income remaining after annual rent: $60,580

- Percentage of income remaining after annual rent: 63.6%

#19 Boca Grande, FL

- Percentage increase in median home sales price: 14.1%

- Annual median household income: $58,750

- Median monthly rent amount: $1,775

- Income remaining after annual rent: $37,450

- Percentage of income remaining after annual rent: 63.7%

#18 Lawrence, NY

- Percentage increase in median home sales price: 16.0%

- Annual median household income: $106,597

- Median monthly rent amount: $3,138

- Income remaining after annual rent: $68,947

- Percentage of income remaining after annual rent: 64.7%

#17 Sands Point, NY

- Percentage increase in median home sales price: 10.5%

- Annual median household income: $112,567

- Median monthly rent amount: $3,138

- Income remaining after annual rent: $74,917

- Percentage of income remaining after annual rent: 66.6%

#16 University Park, TX

- Percentage increase in median home sales price: 13.2%

- Annual median household income: $151,617

- Median monthly rent amount: $4,100

- Income remaining after annual rent: $102,417

- Percentage of income remaining after annual rent: 67.5%

#15 Hewlett Harbor, NY

- Percentage increase in median home sales price: 9.0%

- Annual median household income: $116,754

- Median monthly rent amount: $3,138

- Income remaining after annual rent: $79,104

- Percentage of income remaining after annual rent: 67.8%

#14 Fremont, CA

- Percentage increase in median home sales price: 8.8%

- Annual median household income: $126,754

- Median monthly rent amount: $3,300

- Income remaining after annual rent: $87,154

- Percentage of income remaining after annual rent: 68.8%

#13 San Ramon, CA

- Percentage increase in median home sales price: 5.8%

- Annual median household income: $143,789

- Median monthly rent amount: $3,498

- Income remaining after annual rent: $101,813

- Percentage of income remaining after annual rent: 70.8%

#12 Del Monte Forest, CA

- Percentage increase in median home sales price: 8.1%

- Annual median household income: $130,833

- Median monthly rent amount: $3,150

- Income remaining after annual rent: $93,033

- Percentage of income remaining after annual rent: 71.1%

#11 Newton, MA

- Percentage increase in median home sales price: 5.5%

- Annual median household income: $134,406

- Median monthly rent amount: $3,116

- Income remaining after annual rent: $97,014

- Percentage of income remaining after annual rent: 72.2%

#10 Sea Girt, NJ

- Percentage increase in median home sales price: 5.3%

- Annual median household income: $117,950

- Median monthly rent amount: $2,600

- Income remaining after annual rent: $86,750

- Percentage of income remaining after annual rent: 73.5%

#9 Mantoloking, NJ

- Percentage increase in median home sales price: 9.3%

- Annual median household income: $84,167

- Median monthly rent amount: $1,825

- Income remaining after annual rent: $62,267

- Percentage of income remaining after annual rent: 74.0%

#8 Winchester, MA

- Percentage increase in median home sales price: 7.4%

- Annual median household income: $152,196

- Median monthly rent amount: $3,300

- Income remaining after annual rent: $112,596

- Percentage of income remaining after annual rent: 74.0%

#7 Lexington, MA

- Percentage increase in median home sales price: 6.4%

- Annual median household income: $163,309

- Median monthly rent amount: $3,300

- Income remaining after annual rent: $123,709

- Percentage of income remaining after annual rent: 75.8%

#6 Avalon, NJ

- Percentage increase in median home sales price: 12.6%

- Annual median household income: $87,273

- Median monthly rent amount: $1,700

- Income remaining after annual rent: $66,873

- Percentage of income remaining after annual rent: 76.6%

#5 Laurel Hollow, NY

- Percentage increase in median home sales price: 11.1%

- Annual median household income: $164,682

- Median monthly rent amount: $3,138

- Income remaining after annual rent: $127,032

- Percentage of income remaining after annual rent: 77.1%

#4 Stone Harbor, NJ

- Percentage increase in median home sales price: 9.3%

- Annual median household income: $101,484

- Median monthly rent amount: $1,700

- Income remaining after annual rent: $81,084

- Percentage of income remaining after annual rent: 79.9%

#3 West Lake Hills, TX

- Percentage increase in median home sales price: 5.3%

- Annual median household income: $136,138

- Median monthly rent amount: $1,748

- Income remaining after annual rent: $115,168

- Percentage of income remaining after annual rent: 84.6%

#2 Rollingwood, TX

- Percentage increase in median home sales price: 8.4%

- Annual median household income: $136,138

- Median monthly rent amount: $1,707

- Income remaining after annual rent: $115,654

- Percentage of income remaining after annual rent: 85.0%

#1 The Village of Indian Hill, OH

- Percentage increase in median home sales price: 5.4%

- Annual median household income: $113,668

- Median monthly rent amount: $1,300

- Income remaining after annual rent: $98,068

- Percentage of income remaining after annual rent: 86.3%

Conclusion

To be sure, affordability runs much deeper than simply income and rent, but comparing the two figures can help the average person narrow down places where they might want to live or consider purchasing an investment property. And our analysis tells us that even in these already-pricey communities, some are much more in reach for middle class people than others.

Fair Use Statement

Information is power. Please feel free to share our content for editorial or discussion purposes. All we ask is that you link back to this page and give proper credit to our author.

Additional Resources

- U.S. Census Bureau, American FactFinder, interactive table builder. (2019)

- Zillow Research, Rental Listings, Median Rent List Price ($), 3-Bedroom

- Where Home Prices are Rising the Most in America

Published on June 28th, 2019