Published on August 20th, 2020 by Refiguide.org. Reviewed by Peter G. Miller

The Pandemic has upended the real estate market so far in unexpected and varied ways. Record low mortgage interest rates combined with people spending most of their time at home has caused a boom in home buying in many housing markets despite widespread unemployment.

Not only that, but people are moving and considering new locations. Office closures mean that many people are working from home and some employers have suggested this may be a permanent trend. All these trends are conspiring together to cause people to consider moving to new places across America.

Our staff of data professionals here at RefiGuide.org decided to perform an analysis for people looking to buy a home based on affordability. If you are tired of living in a place where homeownership is out of reach because of high prices compared to incomes, where else should you consider living?

We found that the most affordable housing markets in America were uniformly located in the South and Midwest. The most affordable place we looked at in America was Youngstown, Ohio where the median household income in one year is more than the typical purchase price of a home. On the other hand, almost all the least affordable places to buy a home were in California. Of all the markets we examined, Newport Beach was the least affordable market in the country.

***

Fair Use Statement

Information is power. Please share our content for editorial or discussion purposes. All we ask is that you link back to this page and give proper credit to our author.

***

Before diving into the results, it’s worth spending a moment on the methodology and data. In this analysis, we are primarily interested in affordability of housing in an area. To do so, we compared two metrics – income and the cost of a house. How far will the prevailing median household income go toward the purchase price of a home in the city. All income data is derived from the US Census 2018 data and housing data from Zillow’s June 30, 2020 market estimates. We looked at the 609 largest “places” (a designation in the US Census for cities and towns) in America.

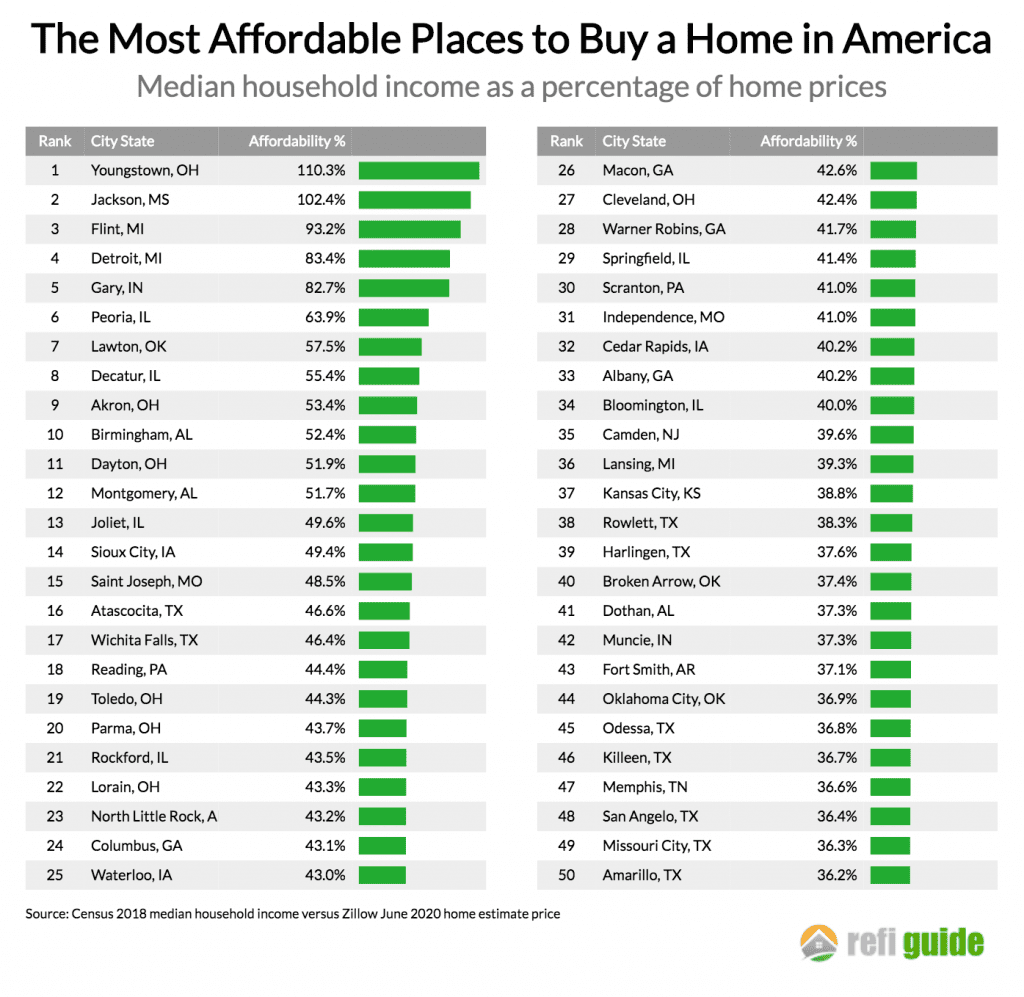

Below are the top 50 most affordable places in America. To calculate the affordability we took median annual income as percentage of home prices in the area.

The most affordable place in America is Youngstown, Ohio, followed by Jackson, Mississippi. In both places, the median household income is higher than the purchase price of a house! Every single city on the most affordable list is located in the South or Midwest. Of the 609 places in America, only 50 places have an affordability score over 36%. The vast majority of places in America are much less affordable.

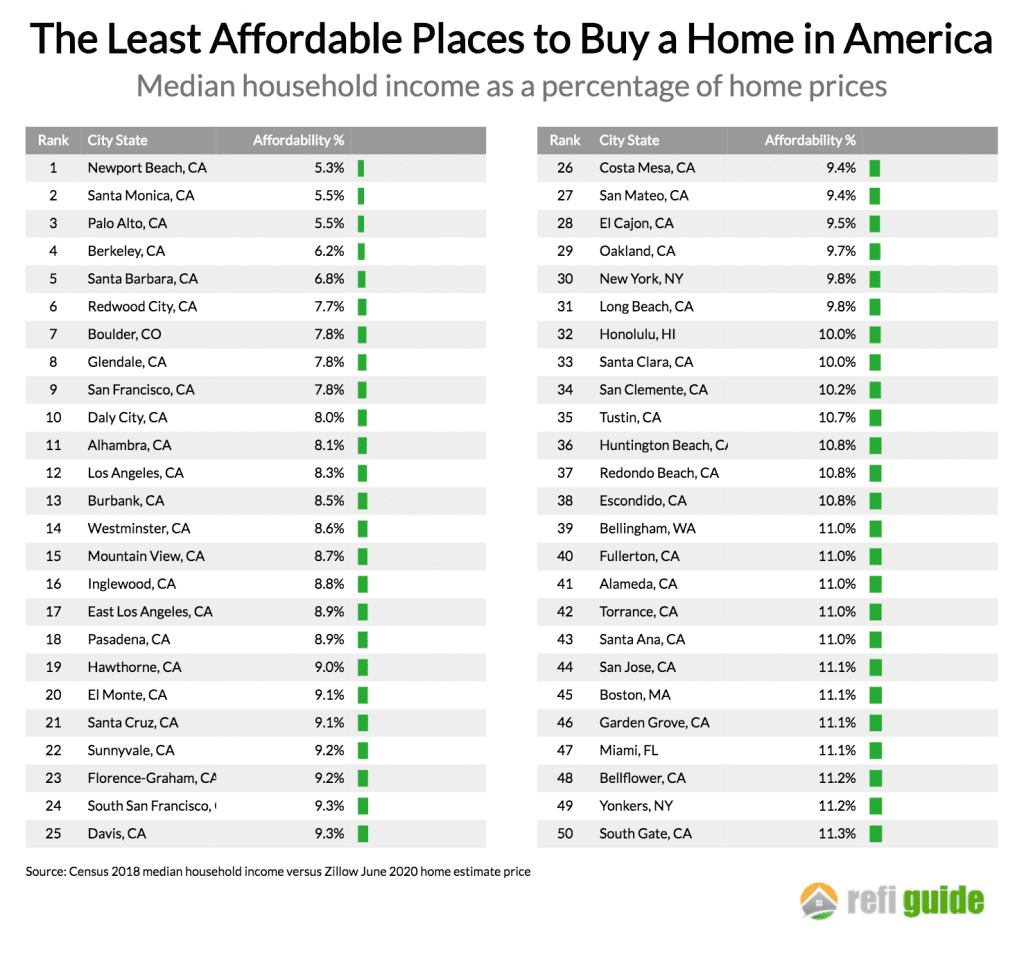

Next, let’s look at the least affordable housing markets in America. The following chart shows the places where the local income does not go particularly far toward a purchase money mortgage:

The least affordable place in America is Newport Beach, California, followed by Santa Monica, California. In these places, the typical annual income covers just 5.3% of a home’s purchase price. In fact 24 out of the top 25 places on the least affordability list are located in California. A few cities in New York, Colorado, Hawaii and Florida also make the list that’s generally dominated by California. With all of the increased home values, it might be time to consider getting some cash with a home equity loan. With interest rate spiking the last few year every time the Federal Reserve raise rates, many homeowners are considering taking out a second lien, rather than refinancing their primary mortgages. Check today’s 2nd mortgage rates.

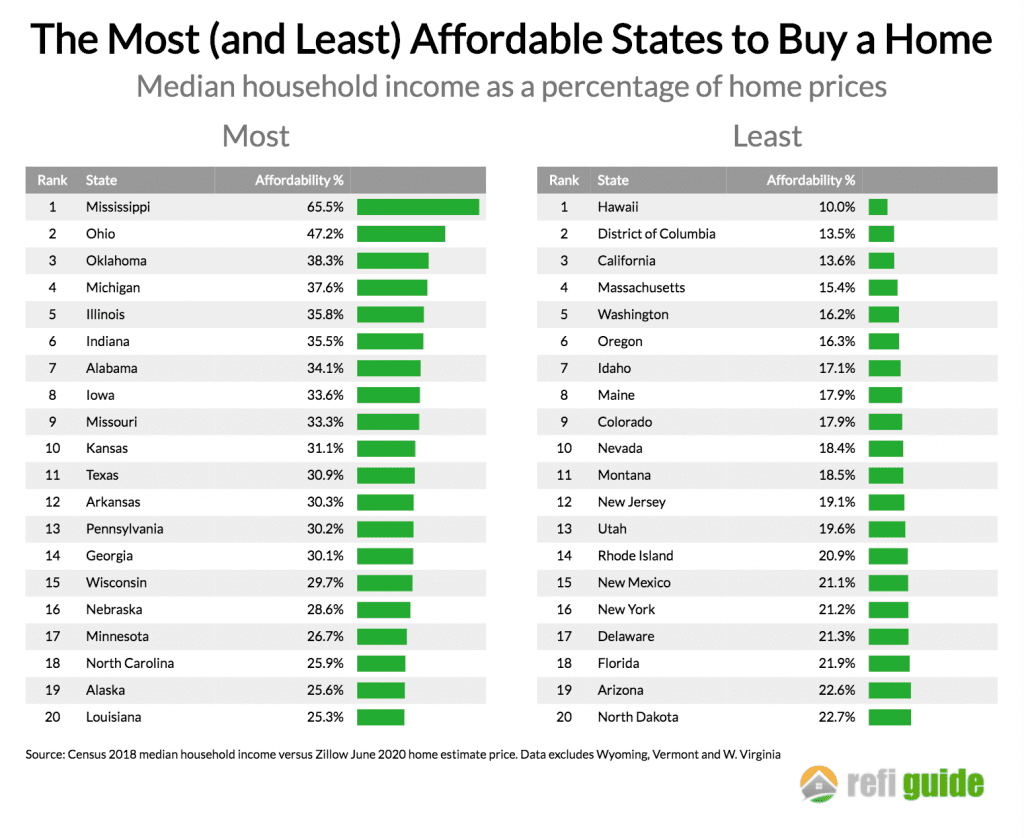

From the two above charts, it seems clear that there is a geographic pattern in affordability. Next, let’s look at the average affordability of all the places in a given state taken together.

The most affordable state in America for homebuyers is Mississippi, followed by Ohio and Oklahoma. Each of the top 12 most affordable states are in the South and Midwest. The least affordable states are Hawaii, Washington DC, and California. The least affordable places are all in the West and East of the country.

Lastly, let’s look at the 50 largest housing markets according to Zillow. These places tend to have the most job opportunities and largest economies, which can be a major factor in the long term affordability of a city, even in the area of remote work.

Of the largest 50 housing markets in America, Detroit, Michigan is the most affordable where a household’s salary covers 83.4% of the home’s purchase price. Each of the top 5 cities are in the South or Midwest. San Francisco is the least affordable major city in the country, followed by Los Angeles and Oakland. The top 6 of the top 10 cities are in California with New York, Honolulu, Boston and Miami also making the least affordable major cities list.

***

Housing affordability has long been a hot button issue in America. Over the last decade housing prices have increased at a tremendous rate and made homeownership beyond the reach of many Americans.

A couple of different forces are affecting the housing market as a result of the pandemic. On one hand many people are laid off, meaning many people in the economy are housing insecure. On the other hand, many Americans are using the pandemic to reassess where they want to live. To assist those that are considering a move, below is a data sheet for the housing prices, median income, and affordability rate of over 600 places in America.

Fair Use Statement

Information is power. Please share our content for editorial or discussion purposes. All we ask is that you link back to this page and give proper credit to our author.