Most home buyers will choose either a conventional loan or an FHA insured mortgage in 2023. If you have decent credit in the mid-600’s or higher, you may be considering either an FHA or conventional loan. Both programs have loans available with 3% to 3.5% down payments, so which is the best option? It depends upon several factors that we will highlight below. When shopping home loans there is a lot more to it than just comparing interest rates and lending fees.

Your choice between conventional and FHA loans should be based on your credit score, down payment capabilities, and property type. Conventional loans can be advantageous for those with excellent credit and a significant down payment, while FHA mortgages offer an excellent opportunity for borrowers with lower credit scores and limited down payment funds. Consider your specific circumstances and long-term financial goals to determine which program best suits your needs.

FHA Versus Conventional Loan Programs – Which Mortgage Is Best for You?

When comparing FHA and conventional mortgage programs, it’s essential to consider your financial situation and priorities. Conventional loans, which are not backed by the government, typically require a higher credit score, usually starting at 620 or higher. They often demand a substantial down payment, usually 5% or more. However, they offer more flexibility in terms of property type and loan amounts, making them suitable for various housing options.

On the other hand, FHA loans, insured by the Federal Housing Administration, require a lower credit score, sometimes as low as 500, making them accessible to borrowers with less-than-perfect credit. They also allow a lower down payment, often as low as 3.5%. FHA loans have limits on the loan amount, varying by location, and they necessitate mortgage insurance throughout the loan’s duration.

FHA financing is backed by the Federal Housing Administration and requires a 3.5% down payment. FHA loans generally are the best bets for those with lower credit scores and past credit problems. For example, if you had a bankruptcy in the past three years, you may want to consider an FHA finance option.

Conventional loans are not directly backed by the US government and take higher qualifications for approval. Investors in the open mortgage market buy investment products that contain these purchase money loans. Free market investors want to take the lower risk, so conventional loans are designed for people with higher credit profiles.

The Difference in Payment with FHA and Conventional Loans

In most cases, FHA rates are nearly the same as conventional rates for most borrowers. This might be surprising, but FHA loans are backed by the government, so lenders are able to offer lower rates. You might see a rate for an FHA loan .25% or .5% lower than a conventional loan. Rates for FHA loans are fairly uniform regardless of credit score.

You will usually see a lower payment per month for the FHA loan, even when you consider mortgage insurance costs. Mortgage insurance or PMI costs more with conventional loans depending upon your credit score; for FHA home loans, the cost is the same for all types of borrower.

What Credit Scores Are Needed for FHA and Conventional?

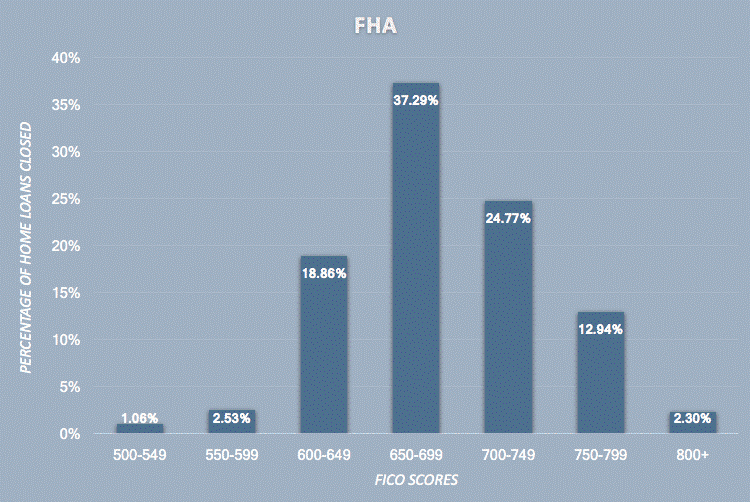

First, let’s consider the average fico scores for borrowers that took out a loan insured by the FHA.

The average fico score on FHA loans above reveals that most FHA liens have scores between 650-699. FHA still approves borrowers with minimum credit scores as low as 500, but a 10% down-payment is required below 580 scores. The reality is that it is till not a sure-thing to be approved for FHA loan with a low score.

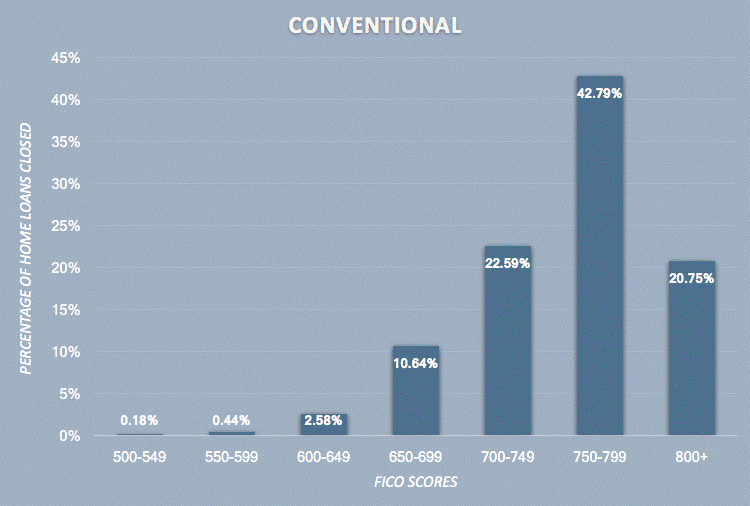

Clearly the average borrower that takes out a conventional mortgage has a higher fico score than those who choose an FHA mortgage. In most cases, the conventional borrower will pay less in mortgage insurance premiums because they have higher fico scores on average.

Differences in Mortgage Insurance Payments

Conventional mortgage insurance stays the same for the entire loan until you reach 20% equity. At that time, you can have the PMI canceled. The FHA mortgage insurance amount is based upon what the balance of the loan is. It is calculated annually. As you pay the loan balance, the cost of the insurance goes down. This is a benefit you can enjoy even more by paying down the loan amount faster than necessary. However, note that if you put down less than 10% with an FHA loan after June 2013, you cannot cancel mortgage insurance. The only way to get rid of that monthly payment is to refinance eventually into a conventional mortgage. If you do not like paying mortgage insurance beyond 20% equity, consider conventional or refinance.

Want to Make Big Principal Payment?

If you plan to pay down a big chunk of your mortgage at once in the first three or five years, you may want to get a conventional loan. Conventional loans, as noted above, allow you to cancel PMI when the loan balance is below 80% of the home’s value. If you are going to pay down the mortgage a lot, you may be able to cancel your mortgage insurance faster with the conventional loan. With the FHA program, you probably cannot cancel it.

Comparing Closing Costs with FHA and Conventional Loans

Closing costs are not a major factor because they are similar for both loans unless you count the upfront mortgage insurance premium charged by FHA. Neither loan will let you roll your closing costs into the loan, but FHA lets you roll the upfront mortgage insurance cost into the loan. You will need to pay for all other closing costs from your pocket.

Remember for both loans that the funds in your bank account for the down payment and closing costs have to be seasoned. This means they must have been in there for at least 60 days before closing.

So, Is FHA or Conventional Better?

A few years ago, most people in the industry would have said that conventional loans are cheaper, but FHA mortgage insurance premiums were reduced in 2015 and made them more competitive with conventional loans. FHA mortgages and the 5% down conventional loan usually start with a similar payment. The major benefit of an FHA loan is you can put down only 3.5%. Also, the rate for an FHA loan is lower.

The 3% down loan option with conventional loans has the highest payment of the three options, but its down payment is slightly less than FHA. The mortgage insurance on this product will cancel at year 10.

Both FHA and conventional programs offer competitive terms and rates on first time home buyer loans.

Which option is for you depends upon you. If you want to keep the home for up to 10 years and do not plan to pay down the mortgage all at once, an FHA loan is often the best bet. But between years 10 and 20, the conventional loan may be more attractive as mortgage insurance disappears.

If you are concerned about FHA mortgage insurance, remember you can refinance after you reach 20% equity if your credit is good enough.

Consider the FHA option if you plan to own the house for up to 10 years and do not mind having to refinance to get rid of mortgage insurance. But take conventional if you can put down 5% and plan to keep the home for more than 10 years.

References:

- Thanks to RubyHome.com for the graphs.