The RefiGuide has been educating home buyers on credit score requirements on FHA loans for over a decade. What are today’s FHA credit score requirements? This is one of the most common questions we get from consumers looking to buy a home with an FHA loan. The applicants frequently ask, What credit score for FHA mortgage programs is required to be approved this year?

People want to know what credit score is needed to qualify for a FHA loan in 2026. I am frequently emailed questions like, “Can I get a FHA loan with a 580-credit score?” or “Can I buy a home with a FHA loan if my credit score is under 600?” or “How much of a down-payment would I need to bring in to qualify for a FHA mortgage with a 500-credit score?”

The credit score required for FHA loan options remain the same for 2026. The RefiGuide helps consumers compare FHA minimum credit score requirements from multiple lenders.

FHA Offers Loans with Low Minimum Credit Score Requirements

One of the key attractions of FHA home loans is the relatively low credit score requirements compared to conventional mortgages. While traditional mortgage products like Fannie Mae or Freddie Mac might demand higher credit scores, FHA loan products are more forgiving, making them an appealing option for individuals with limited credit history or past financial setbacks.

- Low minimum credit score for FHA loan

- 500 FHA minimum credit score

- Easy FHA credit score requirements

The FHA does not actually require minimum credit score requirement. Rather, FHA has created more of a “big picture” approach to evaluate a borrower’s creditworthiness. Typically, FHA-approved lenders consider multiple factors, including credit history, debt-to-income ratio, and the ability to come up with the funds for the down payment.

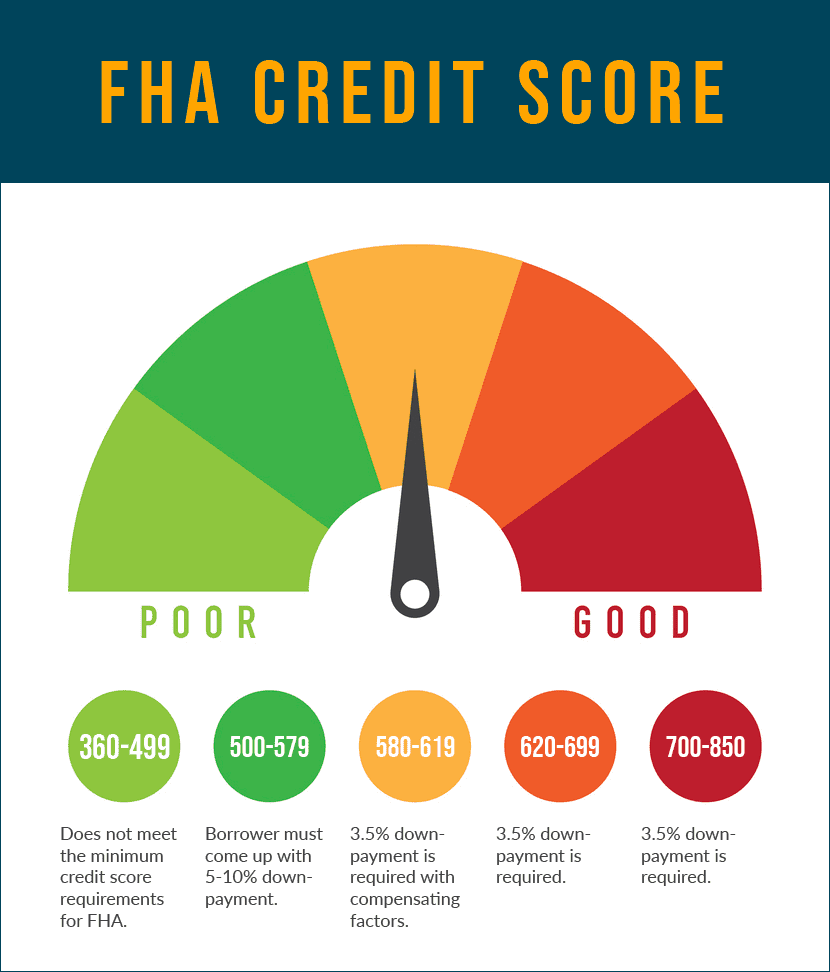

In most of the lending circles lenders are considering borrowers with credit score of at least 580. In addition, FHA approved lenders require to a 3.5% minimum down payment and a satisfactory debt to income ratio.

However, people with credit scores below 580 may still be eligible for a FHA loan, but they might be asked to provide a more significant down payment to balance the risk factor. Most HUD-approved lenders offering FHA loans for credit scores under 580 are looking for a 10% down-payment.

Let’s address these common questions about FHA credit score requirements now. Presently, we live in a credit-driven country and home financing, pre-approvals and mortgage qualification letters all involve credit scores published by Trans Union, Experian and Equifax. I will do my best to address the minimum credit score for home loans insured by FHA in this article. It is crucial that you keep up with the latest FHA credit rules and guidelines before shopping interest rates and making plans. Learn how to buy a house with a FHA mortgage.

Do Mortgage Lenders Still Approve FHA Loans with 500 Credit Scores?

For years there was “No minimum credit score for FHA loans.” A few years back, HUD made some guideline changes and instituted a 500 minimum credit score for FHA loan programs. So, yes, qualified applicants can still get FHA loans with bad credit.

Keep in mind that most lenders, brokers or banks will implement their own FHA minimum credit score requirements and in most cases its higher than 500. You see, the Federal Housing Administration allows HUD approved lending companies to add layers in the underwriting criteria to the baseline FHA loan income limits & requirements.

Of course, in most instances, if you are looking for a FHA loan for poor credit, you will need to present the underwriter some compensating factors, so they feel comfortable approving a mortgage with credit in the 500 to 580 fico range. If you have not established credit yet, apply for a home loan with no credit score.

What Are Credit Score Limits for FHA Loans?

Anyone who wants to buy a home and has credit challenges will likely be considering a loan that is guaranteed by the Federal Housing Administration or FHA. If you are considering purchasing a house this year, it is important to know what the minimum credit score for FHA financing is so you can plan and save accordingly. FHA remains the most popular choice for home buyers seeking loans for credit scores under 600.

The reality is that minimum credit score for FHA mortgage programs will vary depending upon which HUD-approved mortgage lender you are speaking with. You see even though FHA only requires a 500 minimum credit score, many lenders will create their own minimum credit score for FHA loans because they do not wish to take on a risk that big. These first time home loans are quite easy to qualify for because the FHA loan requirements are so flexible. This opens the possibility of homeownership for millions of people who otherwise would have trouble qualifying for a loan.

Where Can I Find a FHA Loan with a Credit Score Below 600?

Even though most approved FHA sources typically cap loans for credit under 600, at 580, there are still HUD-approved lenders and brokers offering FHA loans down to 500. As of today, you need to have a credit score of at least 500 to get a home loan from FHA. If you want to make the minimum down payment of only 3.5%, you will need a credit score of 580 or higher.

However, poor credit borrowers should realize that many FHA approved lenders will require you to have credit scores of 620 to 640 to get an FHA mortgage. Individual lenders have the flexibility to have stricter lending criteria which is frequently higher than the minimum credit score for FHA mortgage loans.

Some experts think that FHA may ease lending standards more in 2026 and this could allow hundreds of thousands more families to buy a home. Qualifying for a FHA loan with fair credit below the 600 fico range remains a very strong niche for government approved lending companies, as there is a huge pool of these types of borrowers seeking affordable financing.

What is the Average Credit Score for a FHA Mortgage Loan This Year?

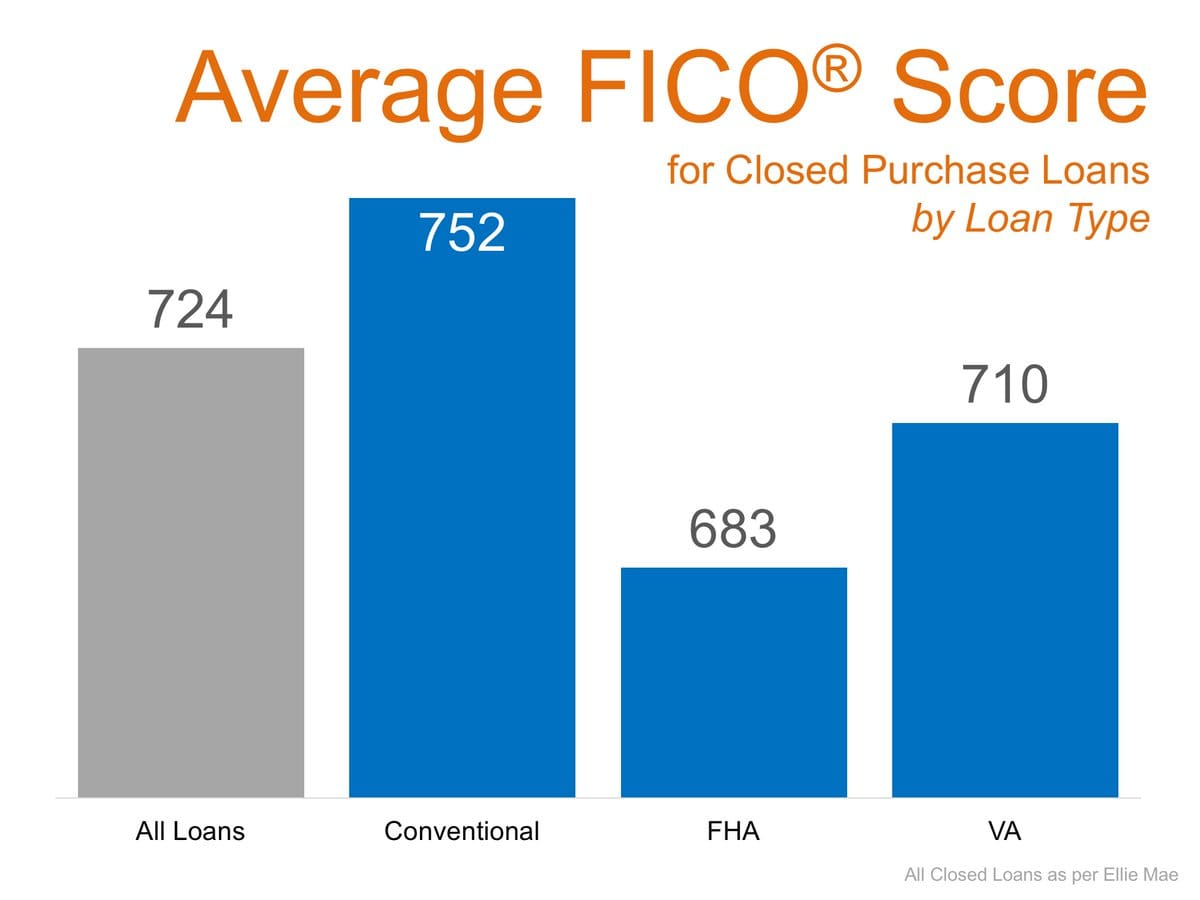

We get inquiries all the time asking about what the average FHA credit score is so let’s consider the available statistics. The average credit score for FHA loan used for the purposes of refinance a mortgage is 654. Whereas, the average credit score for FHA mortgage used for the purposes of home buying is 686.

This doesn’t mean that HUD and FHA won’t approve the application for a person with a lower credit score, but it does give you some data with respect to the average credit scores approved on FHA loans. For the most part, it is more likely to qualify for with a 600 credit score or higher, when considering a loan program that is insured by the Federal Housing Administration.

As mentioned, the FHA credit rules are more lenient for applicants with below-average credit. You can tell as noted that the average FHA credit score for home buyers being at 686 boasts well for the strength of the FHA mortgage product as borrowers with higher fico scores see the value in FHA financing.

The competitive interest rates, reasonable lending costs and minimal down-payment requirements make the FHA loan very appealing to first time home buyers with all types of credit. FHA loan requirements have always been centered around credit and affordability.

Updated Credit Rules on FHA Loan Requirements

FHA loans are among the easiest mortgage loans to get in 2026. A few years ago, the minimum score to get an FHA loan fell to 500. While it is not easy to be approved with a score this low, it is possible. To get a 3.5% down payment loan, you are required to have a 580-credit score.

However, the average credit scores for FHA borrowers is much higher. For new purchase, recent data shows the average FICO score was 683, and for refinance, it was 646. Ellie Mae has found that 80% of FHA borrowers have a credit score of 600 or more, and 13% have a score between 550 and 599. The overall average FHA credit scores enough that some borrowers may have been approved for conventional loans, but they may have been attracted to FHA loans because of the low interest rates or down payments.

It is possible to get a loan approved through FHA with a lower score. Surveys show that 96% of FHA approved lenders will approve loans for people with a 580-credit score. The down payment of 3.5% is among the most lenient, as well. While you can get an FHA loan with a lower credit score, this is not a subprime loan program. FHA lenders will approve certain borrowers with lower credit scores if they had past credit problems but have stabilized recently. FHA mortgage lenders will not simply approve someone with a poor credit score who continues to have current credit problems.

According to FHA guidelines, borrowers who are making current and recent payments on their obligations on time are a lower risk, even if they have a lower credit score. On the other hand, if the credit history shows slow payments and late accounts, the loan may not be approved, even if you have a good enough income. Mortgage data analysts have said that just 2% of FHA loans went to people in recent years with credit under 550.

What Credit Score Is Needed for an FHA Loan?

To qualify for an FHA loan, the minimum credit score requirement is 500 with a 10% down payment. However, borrowers with a 580 or higher score can qualify with a 3.5% down payment. Some lenders may have stricter requirements, asking for a minimum score of 620 or higher, depending on their specific underwriting policies.

Can I get a FHA Loan with No Credit?

While you do need to have a minimum credit score in most cases to get an FHA loan, there are possibilities for people with no credit at all. Lenders are not allowed under FHA rules to automatically deny you with no credit. Instead, it is recommended to get accounts like credit, such as cell phone bills, utilities and insurance payments, to help you qualify for a loan. Some FHA approved lenders can approve your loan with nontraditional credit such as this.

Can I Still Get Approved for a FHA Loan After Major Credit Problem?

A lot of people after the last mortgage fueled fiscal crisis had their credit rating tank. This may make you think that you cannot get a mortgage loan with a bankruptcy or foreclosure. This is not true. For an FHA loan, it should be two years after the Chapter 7 to get a loan approved, and three years after a foreclosure. But these waiting periods may be adjusted if there were events beyond your control that led to the problems.

Remember, you can get still approved for an FHA loan with a lower credit score, IF you have shown enough income and financial stability in the recent past to support the payments.

How Was the FHA Credit Policy Updated?

FHA recently added another type of evaluation of potential lenders.

The current policy has been to compare an approved FHA mortgage company with another FHA lender in the same part of the country. This is called the FHA compare ratio.

If the lender had 150% more loans that paid late than other lenders in the region, it could get removed from the FHA approved lender list.

Many lenders had a problem with this standard. If some lenders in the area have higher FHA credit standards than theirs and a lower default rate, other lenders in the area would look worse.

This led to lenders increasing their minimum score required as high or higher as other lenders in the area. So the credit standards continued to creep up, which goes against the purpose of the entire FHA-mortgage program.

Under this system, an FHA lender could be kicked off the FHA program if the lender across town raised its credit score minimum to 680 from 640. Now, there is another layer of evaluation by FHA.

The Federal Housing Administration will look separately at loans that are paid late based upon credit scores of under 640; between 640-680 and more than 680. This should help borrowers with lower credit scores to qualify for loans. The lender will no longer risk losing its FHA approved status if its lower credit score loans perform in similar fashion to other loans in the same score bracket. Also, the comparison is going to be made around the country and not just in a single geographic area.

Under the new rules FHA will compare a lender’s higher default rate with lower credit score loans to the national average for all loans under 640. This makes it more likely that the lender will be able to continue to do business with lower credit score borrowers.

Keep in mind that it may take time for the new FHA minimum credit score policy to be rolled out. Lenders often wait for other lenders to implement the new guidelines to see how things shake out. If you are a lower credit score borrower, you could be talking to some lenders who have adopted the new standard while others have not. So. It will pay to shop around and get quotes from several lenders that offer home loans for credit under 600, 580, 550, etc.

Why First Time Home Buyers and Homeowners Turn to FHA Mortgage Loans for Credit Challenges

Conventional loans that are offered by Fannie Mae and Freddie Mac are good products but they are fairly strict on lending criteria. If you have credit under 700, you may have difficulty getting a loan approved. The FHA credit score requirement is almost always easier to meet than Fannie or Freddie lending guidelines.

The FHA minimum credit score has always been lower and in 2026 we continue to see that FHA mortgages are easier to qualify for in most instances. The Department of Housing and Urban Development has maintained FHA loans for low credit as a priority over the last few decades.

FHA allows many more people to get approved for a loan with these criteria:

- Poor credit from 500 to 620

- Low income

- Income from several sources

- Co-borrowers who may not live in the home

- Ability to get down payment from gift funds

- Homes that need repairs

Without FHA, many more American families would have to pay rent for many years more. However, there are still ways that FHA can expand home ownership to more Americans. The Department of Housing and Urban Development has made strong efforts to preserve FHA minimum credit score requirements to stimulate the housing sector in the U.S.

Another very helpful part of the FHA program today is that it recently increased the maximum loan amount that FHA will insure to $424,100. So even if you are buying a quite expensive home, you may be able to get an FHA mortgage. If the home is in an expensive area such as California, the maximum FHA loan limit is $625,000. So with even expensive homes in expensive areas of the US, FHA financing is still a good possibility.

The Skinny on FHA Credit Scores and Qualifying Criteria

Anyone with poor to average credit who wants to buy a home should talk to several FHA mortgage lenders right away.

If you have a credit score at least in the low 600’s, you should be able to find many FHA approved lenders and subprime mortgage brokers who may be able to assist you in getting you approved for a mortgage.

It will always benefit you to talk to a lot of lenders because some lenders may be able to offer you a lower rate on a certain loan product.

FHA approved lenders have considerable leeway in their lending criteria.

Even if you need a loan and have a credit score under 600, do not lose hope. There are still some FHA mortgage companies out there who may approve your loan.

Under the new lending criteria mentioned above, there will probably be even more approved FHA brokers in 2026 and beyond that will work with poor credit borrowers. For people interested in an alternative to FHA, check out our credit guide for all types of home loans.

How FHA Helps Home Buyers with Bad Credit Get Approved for Affordable Mortgage Loans

There are many potential homeowners in America who still are suffering from low credit scores left over from the mortgage meltdown a few years back.

For far too many Americans, job loss, foreclosures and bankruptcy really hurt their credit scores.

Even nearly 10 years after the meltdown, there are still millions of people renting a place to live. Home ownership is still near record lows for the last 50 years.

But despite what you think, you may still be able to get a FHA home loan with bad credit. That is right.

You may be able to get approved for a home loan with bad credit with good terms and affordable interest rates.

Why Do FHA Loans Work for People with Bad Credit?

FHA mortgage loans as well as FHA cash out refinance programs were first offered in the Great Depression. Since then, FHA has helped 40 million families to buy a home. It is so popular because it has very flexible loan criteria. This program was built from the start during the Depression to get home people into their own homes. The federal government sees it as desirable for Americans to own their home rather than rent, if they can afford the mortgage payment.

In many circles across the country, people consider FHA the best path to get a mortgage loan with bad credit qualified.

Fannie Mae and Freddie Mac are popular programs for first time home buyers but their financing options are not as flexible with credit and income criteria as FHA home loans. FHA mortgages offer a potential solution to bad credit buyers to get approved. Here’s how:

- FHA Credit scores as low as 500 are allowed

- More options are available to those with 600 to 640 credit for FHA Loans

- Lower level of income allowed on home loans with credit under 600

- Income from several sources. FHA mortgages are very popular for the self employed

- You can have co-borrowers who are not going to live in the house

- You may get most or all of your down payment in the form of a gift

- Homes that need substantial repair may qualify

More Specifics on Credit Score Requirements for FHA Loans:

For many individuals aspiring to own a home, securing a mortgage is a pivotal step in the journey to homeownership. The Federal Housing Administration (FHA) plays a significant role in making this dream a reality for a broad spectrum of Americans, especially those who may face challenges in obtaining traditional loans. FHA loans are known for their more lenient eligibility criteria, particularly in terms of credit scores, making homeownership accessible to a wider range of applicants.

The FHA, a government agency within the Department of Housing and Urban Development (HUD), insures loans provided by approved lenders. This insurance mitigates the risk for lenders, enabling them to offer more favorable terms to borrowers, even those with less-than-perfect credit.

A significant advantage of FHA loans is the consideration of factors beyond credit scores. Lenders may take into account the reasons behind a lower credit score, such as a one-time financial setback or extenuating circumstances. This approach recognizes that individuals with a less-than-ideal credit history may still be responsible borrowers.

Applicants with a history of bankruptcy or foreclosure may also qualify for an FHA loan, but there are waiting periods involved. For a Chapter 7 bankruptcy, the waiting period is generally two years from the discharge date, while Chapter 13 bankruptcy filers may be eligible after one year of consistent payments and with court approval. Foreclosure generally requires a waiting period of three years.

It’s crucial for prospective homebuyers to be proactive in improving their creditworthiness. Paying bills on time, reducing outstanding debts, and avoiding new debt can contribute to a positive credit profile. FHA loans, with their flexibility, offer a pathway to homeownership for those committed to rebuilding their credit.

While FHA loans provide opportunities for individuals with lower credit scores, it’s essential to be mindful of the associated costs. FHA loans require mortgage insurance premiums (MIP) that serve as a form of protection for the lender against potential losses. MIP includes an upfront premium paid at closing and an annual premium that is typically divided into monthly payments.

FHA home loans play an integral part in making homeownership more available by providing unique opportunities with more flexible credit score requirements. While there is no specified minimum credit score, a FICO score of at least 580 is often desirable for the 3.5% down payment option.

Applicants with lower credit scores may still qualify but might need to make a larger down payment. The beauty of this is reflected by FHA-approved lenders that consider multiple factors, and ultimately provide a pathway to homeownership for Americans with diverse backgrounds.

We recommend that people aspiring to be homeowners explore their eligibility, work on improving their creditworthiness, and engage with lenders experienced in FHA mortgages to navigate this accessible route.

These questions and responses provide an overview of how credit scores impact FHA loan eligibility.

More FAQs for FHA Credit Requirements

Here are some of the most frequently asked questions regarding FHA credit score requirements:

What Is the Credit Score Required for FHA Loan programs in 2026?

In 2026, FHA guidelines still allow borrowers to qualify with credit scores as low as 500, depending on down payment and lender requirements. Borrowers with scores of 580 or higher may qualify for FHA’s minimum 3.5% down payment, while scores between 500–579 typically require 10% down. Keep in mind that many lenders impose stricter “overlay” requirements, often preferring scores of 600 or above for easier approvals and better loan terms.

What is the Minimum Credit Score to Buy a House with FHA?

The FHA minimum credit score to buy a home is 500, but approval depends heavily on the lender. Borrowers with a 580+ credit score can access FHA’s most popular option—3.5% down—while those below 580 usually need a larger down payment and compensating factors. Lenders also review payment history, debt-to-income ratios, and recent credit behavior, so improving your score before applying can significantly boost approval odds.

What Is the Minimum Credit for an FHA Loan if I Have No Equity?

For home purchases where equity doesn’t yet exist, FHA requires a minimum 500 credit score, but most buyers will need 580 or higher to qualify for low-down-payment financing. Since there’s no existing equity to offset risk, lenders focus more on credit history, income stability, and debt ratios. Borrowers with lower scores may face tighter underwriting, higher mortgage insurance costs, or lender overlays that raise minimum credit requirements.

Can I Get an FHA Loan with Bad Credit?

Yes, FHA loans are designed to assist borrowers with less-than-perfect credit. If your credit score is below 580, you may still qualify, but you’ll need to provide a larger down payment and might encounter higher interest rates. In cases where the score is very low, lenders might consider alternative compensating factors, such as consistent rent payments or utility bill records, to assess the applicant’s creditworthiness.

Can I Get Bad Credit FHA Mortgages without Income Documentation?

Generally, no. FHA loans require full income documentation, even for borrowers with poor credit. W-2s, tax returns, pay stubs, or verified alternative income sources are mandatory to ensure repayment ability. FHA does not allow true “no-doc” mortgages. Some non-QM lenders offer no-doc options, but those are not FHA insured loans and typically require higher down payments, higher rates, and stronger equity positions.

How to Apply for an FHA Loan with Bad Credit?

To apply for an FHA loan with bad credit, start by checking your credit score and improving any negative factors. FHA lenders typically allow scores as low as 500 with a 10% down payment or 580 with 3.5% down. You’ll need to provide proof of income, employment history, and bank statements. Shopping around for FHA-approved lenders can help find more flexible credit requirements.

Are there FHA lenders that accept a 500 credit score?

Yes, some FHA-approved lenders accept borrowers with a 500 credit score, but there are stricter requirements. To qualify, you typically need a 10% down payment and meet other financial criteria, such as stable income and a low debt-to-income ratio. Sometimes, improving your credit score before applying can also increase your chances of approval and better loan terms. Finding FHA lenders that accept 500 credit scores requires working with specialists. RefiGuide.org helps connect borrowers with FHA-approved lenders that allow lower credit scores and fewer overlays. These lenders often focus on manual underwriting, compensating factors, and alternative credit histories. Comparing multiple lenders is essential, as not all FHA lenders approve 500-score borrowers, and terms can vary widely based on risk tolerance.

Can I Get an FHA Loan with a 580 Credit Score?

Yes, you can qualify for an FHA loan with a 580 credit score if you meet other lender requirements. With this score, you can make a 3.5% down payment, but lenders may also consider your income, debt-to-income ratio (DTI), and payment history. Some lenders may have stricter requirements, so comparing multiple FHA-approved lenders is recommended.

Can I Get an FHA Loan with No Credit History?

Yes, FHA loans allow borrowers with no traditional credit history to qualify. Instead of a credit score, lenders may consider alternative credit sources like rent payments, utility bills, and insurance payments. You’ll need to demonstrate a consistent payment history to show financial responsibility. Working with FHA-approved lenders who accept non-traditional credit can improve your chances of approval.

Can You Get an FHA Loan with Non-Traditional Credit?

Yes, FHA loans allow borrowers with non-traditional credit histories to qualify. If you don’t have a credit score, lenders may consider alternative credit data, such as rent, utility, and phone payment histories. To qualify, you’ll need a strong record of on-time payments for at least 12 months. Some lenders specialize in working with applicants who lack traditional credit, so it’s best to find an bad credit FHA lender experienced in evaluating non-traditional credit profiles.

How Does Credit Score Impact FHA Loan Interest Rates?

A higher credit score often translates into better interest rates. While FHA loans generally offer competitive rates, borrowers with stronger credit profiles are more likely to secure lower interest rates, which can significantly reduce the total cost of the loan over its term. See today’s FHA loan rates.

Can a Lack of Credit History Affect FHA Loan Approval?

Not having a traditional credit history won’t necessarily disqualify you from obtaining an FHA loan. Some lenders will accept alternative credit records, including rent or utility payments, to demonstrate your ability to manage financial obligations. This flexibility makes FHA mortgages particularly appealing to first-time homebuyers or those without a robust credit history.

What Are the Credit Score Limits for FHA Home Loans?

FHA loans require a minimum credit score of 500, but the down payment requirement varies. Borrowers with a 580 or higher can qualify with 3.5% down, while those with 500–579 need 10% down. Some lenders have higher credit score requirements, so comparing FHA-approved lenders is essential to finding the best option.

How Can I Improve My Chances of Getting an FHA Loan?

To enhance your eligibility, focus on improving your credit score by paying down outstanding debt and making timely payments. Saving for a larger down payment can also compensate for a lower credit score. Additionally, exploring lenders that offer lenient FHA lending criteria can improve your chances of securing a loan with favorable terms.