The incentives for first time home buyer programs have never been better for people seeking great loans and down-payment assistance. Becoming a homeowner is quintessential part of the ‘American dream’, so obtaining the right mortgage is a critical step in the first time home buyer process. It’s no secret that the U.S. housing market has been surging, so it is natural that mortgage companies are comfortable expanding credit and home loan financing for first time home buyers that can demonstrate being a worthy borrower.

Explore the Best First Time Home Buyer Loan Programs with Affordable Rates for All Credit

- Shop First Time Home Buyer Loans with Competitive Mortgage Rates

- Compare Lenders for First Time Home Buyer Mortgages in All 50 States

- Find Zero Down Home Loans for First Time Buyers

We created this step by step guide to simplify the mortgage financing component so that first time home buyers do not waste any time, money or miss out on any opportunities to become homeowners. Having the foresight and ability to secure the right mortgage loan as a first time buyer without breaking the bank is an important financial step in becoming a balanced homeowner in the United States.

A multitude of first-time homebuyer loan programs is available through banks, mortgage lenders, local governments, and community organizations. These 1st time loan programs encompass affordable home financing, tax incentives, aid with closing costs, and initiatives for down payment assistance. Ask about first time home buyer loans with zero down.

Mortgage Tips for First Time Home Buyers

Buying a home is not an easy process for many people. From the worries about all of the paperwork to the fees and the sheer number of people involved, it is easy to be overwhelmed. If you are a first-time home buyer, you also may not have a lot of capital available for buying your home. But there is good news!

Today the US mortgage market has many down-payment assistance programs that can help the first-time home buyer to get into their first property easier than in the past. With default and delinquencies rates diminishing banks and mortgage companies are willing to take more risks. In many instances it means you just might qualify for a competitive home loan with reduced closing costs and less paperwork, but you better get organized, so the first time home buyer lenders take you seriously.

Below are the best eight down payment loan programs for those who are buying their first home.

-

FHA – Why First Time Home Buyers should consider FHA

This is without a doubt the most popular affordable, low down payment home loan program on the US market. It is especially designed for people with shaky credit or are buying their first home.

The Federal Housing Administration provides a guarantee of most of the balance of the home loan. This allows first time home buyer lenders to make their acceptance criteria more flexible. FHA continues to insure first time home buyers with poor credit scores as long as they can check the other boxes of being a borrower.

With a loan that is backed by FHA, you may be able to get a loan with only 3.5% down. This low-down-payment makes it much easier to get a home loan if you are not bringing any equity to the table from your last property.

Find out how much you afford with FHA financing. FHA programs can be had by first time home buyers with only 3.5% down if you have a credit score as low as 580. FHA financing has no income limits; whether you make $30,000 or $300,000 per year, you may be able to be approved for this program. There is a maximum amount that your home can be worth if you want to qualify this program. It varies depending upon the city and region. For most areas of the US, the maximum amount for a home underwritten by FHA is $424,100.

-

USDA – What type of home buyer is a good fit with USDA?

There are not a great number of 100% financing loans left on the US mortgage market. USDA is one of them, however. This program is backed by the US Department of Agriculture, and has been specially designed for lower income and lower credit borrowers who are buying in a rural area. You do not have to be buying a farm either.

There are some homes in suburban areas outside of large cities that is guaranteed to applicants that meet the USDA loan guidelines. There are income limits on this program, so you should check with your mortgage lender. This first time home buyer program also features very flexible credit standards, and it OK if you have a foreclosure or even a bankruptcy in your past. Visit the US Department of Agriculture website to learn more about first time home buyer eligibility under the special USDA program.

-

VA – Why borrowers with military credentials typically choose VA

This is another 100% financing program that is available with first time home buyer loans. This program is sponsored by the US Department of Veterans Affairs, or VA. The, 100% VA home loan program is available to those who were or are in the US military.

It also is made for the surviving spouses to buy homes as well. It is made for military veterans, so as you may expect, it is very generous. You can get 100% financing with very flexible credit standards, generous debt to income standards, and no mortgage insurance. If you can qualify, this is one of the best, most generous first time home buyer loans with bad credit made for eligible military applicants.

-

FHFA First-Time Home Buyer Mortgage Rate Reduction

In 2023, the Federal Housing Finance Agency (FHFA) announced rate reductions for 1st-time homebuyers across all loan programs to enhance affordability. This first time homebuyer program decreases supplementary interest rate charges for qualifying first-time buyers, resulting in potential savings of up to 1.75% on their mortgage interest rate.

-

Fannie Mae and Freddie Mac – How they making first time home buying appealing

These government entities currently back a large percentage of the US mortgage underwritten in the United States each year. There are more first time home buyer loan programs available today with Fannie and Freddie. These government programs only require a first time home buyer down-payment to be 3-5%, in most instances. Note that you generally need to have a credit score above 640 and ideally 680 or higher to qualify.

If you have a credit score that is below this, consider the FHA program mentioned above. Visit Fannie Mae and learn about the new HomeReady program. Learn about exciting home buying grants from Freddie Mac.

The Home Possible Loan – This represents a mortgage option with a 3% down payment requirement, like the HomeReady. It provides reduced mortgage rates and expenses designed to assist low- and moderate-income homebuyers. This home mortgage type is accessible in both fixed-rate and adjustable-rate formats.

-

203K Loans – When a rehab loan makes sense as a first time buyer

Another advantage of the FHA program is that you can combine your FHA loan with a HUD 203k loan for doing repairs on your property. This is ideal for the first time home buyer who wants to buy a fixer upper. This FHA-backed loan will consider what the value of the home is after the repairs are done. You can then borrow the funds needed to complete the approved repairs. This is a great deal for buyers because you can borrow your rehab funds at a very reasonable rate.

-

Dollar Homes – Is this for real?

It might sound too good to be true. But there are HUD homes that are made available to buyers for as little as $1. These homes are taken over by FHA after the foreclosure process. There are only a small number of homes available for the most part, but buyers who are interested in buying an affordable home in certain cities in the US should check it out.

-

Good Neighbor Next Door – New opportunities for teachers and first responders and more

This program was once called the Teacher Next Door Program. Today it has been expanded to include firemen, police, EMTs and other critical workers for the public health. The Good Neighbor Next Door is a HUD program that provides the buyer with up to a 50% discount that are located in an urban revitalization area. It is required to live in the home for at least three years. You can find available home listed on the Good Neighbor Next Door website or read our recent article that discusses the pros and cons of the Good Neighbor Next Door Program.

Qualified first time home buyers are entitled to a 50% reduction in the acquisition cost of HUD properties located in specified revitalization zones. If they choose to finance the house with an FHA loan, they are only required to make a minimal down payment of $100. To secure the purchase price reduction, borrowers take on a silent second mortgage, under which they are not obligated to make payments or pay interest as long as they continue to reside in the property for a duration of three years.

Checklist for First Time Home Buyer Programs

Switching from renting to owning your home is exhilarating for many Americans. But buying a home is a complex process. If you follow the checklist below for the year before you buy a house, your first home purchase process will be much smoother.

Lending Requirements to Buy a House

12 Months Out

- Get your credit score. You should get a copy of your credit report from the three major credit bureaus – Equifax, Experian and Trans Union. Each of them have to give you a free report each year. This is worth doing: An FTC study found that 25% of Americans have found errors in their credit report, and 5% had mistakes that could lower their score. Being first time home buyer with bad credit can be challenging, but it helps to know where you are at with credit before speaking with lending professionals.

- Figure out what you can afford. You should know well in advance how much how you can buy. First time home buyer lenders generally will want to see that your total debt load is no more than 43% of your gross monthly income. This is called your debt to income ratio or DTI. This ratio includes your mortgage and all other monthly debts, such as car payments and credit card payments.

- Plan for your down payment. Most conventional mortgages want to see a 20% down payment, but there are other options available. Generally, it is recommended to put down as much as you can afford. This will lower your monthly payment and reduce the interest you pay. However, you should not let the inability to save 20% prevent you from buying. There are conventional loans with 5% down payments, and FHA offers great programs with only 3.5% down. Whatever you need to save up, banks like to see that the money has been in your bank account for at least 60 days before you apply for the loan.

9 Months Out

- Decide your priorities. What is most important for your home? Do you need to be close to work? Do you need a big backyard? Do you want an open floor plan, or to have a quiet street. You will make a better decision on your first home if you determine priorities early on. If you are deciding with a partner or spouse, now is the time to get differences ironed out, as first time home buyer loan programs have never looked better.

- Research neighborhoods. Use websites such as realtor.com and zillow.com to get a feel for neighborhoods, cost of living and public transportation. Also go to open houses to get a feel for the homes in your price range in neighborhoods you want. Looking at real houses can motivate you to cut debt and save.

- Budget for home purchases expenses. Buying your first home is fun but it’s expensive. You should have cash saved for the home inspection, title search, survey, and home owner’s insurance. Start saving now.

- Save for home maintenance. It is a good idea to put aside money every month to pay for maintenance on your new home. Having to call a plumber isn’t fun, but it’s less fun if you have to put it on a credit card.

6 Months Out

- Get your home loan paperwork together. These days, you have to have all of your documentation together to be approved for a home loan. Be ready with W-2s, tax returns for the last two years, pay stubs, credit card balances, bank statements, addresses for the last seven years, 401k statements, profit and loss statement for the year if self-employed. Have them all together now so you can easily apply for the best first time buyer mortgages.

- Research realtors and first time mortgage lenders. We recommend that you interview several buyers’ agents. A buyer’s agent will help you to find the best home for you. He or she will represent you to ensure that you get the best deal and home for you. Also talk to several mortgage lenders. We recommend a first time mortgage broker who can offer you products from many lenders.

3 Months Out

- Get pre-approved. If you have been following the above steps, you should have your credit score, loan paperwork and down payment in order. You also have researched agents and mortgage lenders. Now you need to get pre-approved. Work with your lender to run your credit and see if you can get a pre-approval for the loan that you want. You should borrow less than you can afford so that you are not house poor.

- Shop for a home. Once you have been pre-approved, you can work with your buyer’s agent to help you find your dream home in your price range.

2 Months Out

- Make an offer. It can take one or two months to close on your home. If you have a date that you need to move out, be sure to allow enough time to deal with any potential delays in closing.

- Get a home inspection. Once the offer is accepted, you should have the home inspected. If something is found that needs to be repaired, this could delay the closing.

Last Month

- Check that all financial documents are in order. If you have all of your documents together and a down payment saved, these steps are the simplest. Going over the mortgage document can be a process, but your agent can help you.

- Get home owner’s insurance. You need to have home owner’s insurance in effect to close.

- Do your final walk through. You should do a last walk through a day or two before you close. Make sure the home is in the same condition as when you first looked at it.

- Get a cashier’s check for cash needed to close. Check that you have the exact amount of cash needed to close. This exact number can fluctuate from day to day. You cannot close a real estate transaction with a personal check, so make sure that you have a source lined up the day before closing to get the cashier’s check.

By following our checklist above, you will ensure that your first-time home buying experience is a smooth process. There is help available if you are buying your first home and have a limited down payment available. Talk to your first time buyer mortgage lender today about the above programs. Buying your first home could be much closer to reality than you might think.

5 Ways to Get a Competitive First Time Home Buyer Mortgage Rate with a Low Credit Score

In the last two years, mortgage lenders have finally started to seriously ease lending restrictions for first time home buyers. A few years back, after the last recession, it became very difficult to get a first time home mortgage unless you had a 20% down-payment and 740 credit. Now even a first time home buyer with bad credit has a legitimate chance to qualify to be a homeowner with affordable first time home buyer programs.

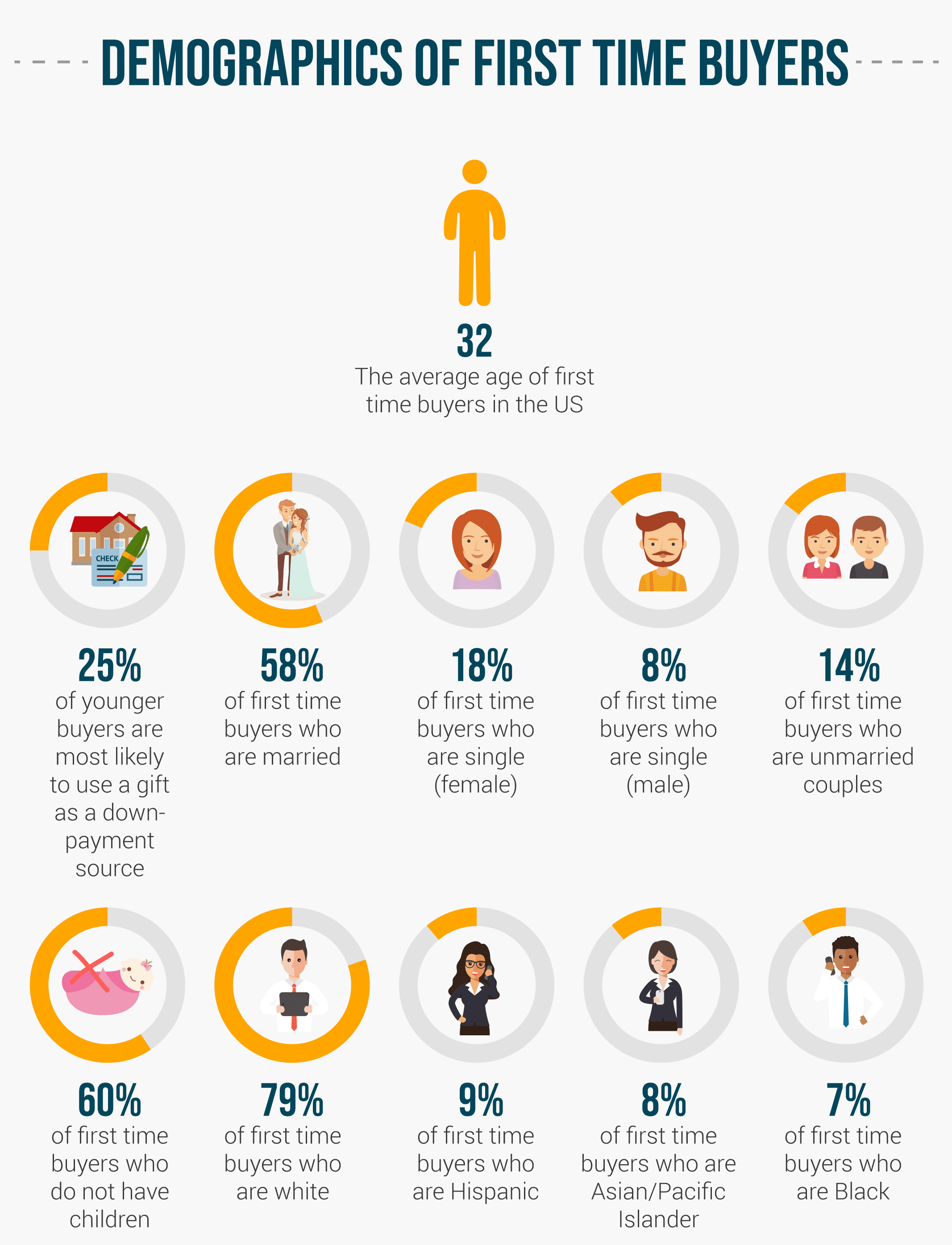

Your credit score is one of the most important factors that lenders consider when you apply for a first-time home mortgage. If you find that you are on the lower end of the credit scale, do not worry too much. It is still possible to get a first-time home buyer loan. And 2025 is a great time to buy your first home! Rents are going up, home values are up, and first time mortgage rates are going down. If you are a first time home buyer with bad credit, do not let a low credit score dissuade you from applying from a mortgage, as there are several programs available if you speak with right lenders. Educate yourself on what the minimum credit scores on home loans are this year for first time buyers.

Know the Score You Need for 1st Time Home Buyer Programs

Your credit score with the three major credit bureaus will give you an idea of how likely you are to be approved for a loan, and what your rate will be. Generally, the higher your score, the more home loan options you have. For a conventional loan, you will want to have a credit score of 660 or higher. This score will give you the greatest number of loan options as a first-time homebuyer. But there are other options for you if your score is not that high. The most popular first time home buyer program for people with low credit scores is the FHA loan. These first time home buyer programs are backed by the Federal Housing Administration. This means that FHA mortgage lenders are able to provide you with a lower rate than you could otherwise expect.

For a bad credit first time home-buyer loan, you only need to have a credit score of 580 to get a down payment of 3.5%. As always, the higher your credit score, the better. But don’t think that you have to have a high score to get a home loan. Programs for first time home buyers with bad credit are often insured by the Federal Housing Administration and widely considered to be a great option that you should ask about if you have credit below 660.

Below are some of the most important reasons to check your credit before you apply for your mortgage:

-

Make Payments on Time

For loan programs such as FHA, your credit score is not as critical as you think. What IS important is that you have a steady payment history for your debt obligations for at least the past year. FHA and other lenders want to see that you are on your feet financially and are making payments on time. We recommend that you have a good payment history going back at least a year, and two is better.

-

Put More Money Down to Qualify for First Time Home Buyer Loans with Poor Credit

If your credit is really poor, you will have a better chance of approval if you put more money down. FHA requires a 580 score for a 3.5% down payment. If you are lower than that, you can still get approved if you put down 10%. So, save up more money for your down payment and your credit score can be lower. Talk to first-time mortgage lenders that offer a clear for buying a home with bad-credit.

-

Don’t Be Afraid to Wait to Buy a Home

It is true that 2025 looks like a great time to get a mortgage. Rates are dropping and home prices are appreciating. But if your score is too low, you certainly should consider continuing to rent and increase your credit score. Make all of your debt payments on time, and you can pay a credit repair company to help to increase your score. In a year’s time, you may be ready to buy your first home. Talk to mortgage lenders about first time home buyer programs.

-

Take a Higher Rate on a Poor Credit Home Loan for 1st Time Buyers

If your credit score is too low to get the best rates, there is nothing wrong with taking a higher interest rate. You may have to take a bad credit first time home loan and pay that higher rate for a year or two until your credit is improved. Then, once your score is higher, you can refinance and get a lower interest rate. Many mortgage experts expect the interest rates to stay quite low for the foreseeable future. Even though the Fed has raised rates three times in the last 18 months, first time home buyer mortgage rates have not changed a great deal.

-

Talk to a Mortgage Lender that Specializes in First Time Home Buyers

If you have a lower score than you want, be up front with your lender about it. Some people have a low score because they had a negative credit event in the last few years. Perhaps you had a bankruptcy or foreclosure. The good news is that negative event does not necessarily prevent you from getting a home loan. You just need to show the lender that you have a good enough income to pay your bills now. You also should show that you have been making on time debt payments for the last 12 months to 24 months. Interest rates are low. Home prices are higher. And lending is much loose than it was five or seven years ago. Even if you have a credit score as low as the high 500’s, you still may be able to buy a home. Sure, you might have to pay a higher rate or put more money down, but you still are usually better off than paying rent.

FAQ for First Time Home Buyer Loans

How much mortgage can I afford as a first-time home buyer?

As a first-time home buyer, you can typically afford a mortgage that keeps your monthly housing costs (including principal, interest, taxes, and insurance) below 28-31% of your gross monthly income. Lenders also consider your total debt-to-income (DTI) ratio, which should ideally be under 43%. Using a mortgage calculator and getting pre-approved can help determine your budget.

What do most first-time home buyers get approved for?

Most first-time home buyers get approved for conventional loans, FHA loans, or VA loans (for eligible veterans). Approval amounts vary based on credit score, income, debt, and down payment. Many first-time buyers qualify for FHA loans with lower credit score requirements and down payments as low as 3.5%. A strong financial profile improves the chances of securing a larger loan.

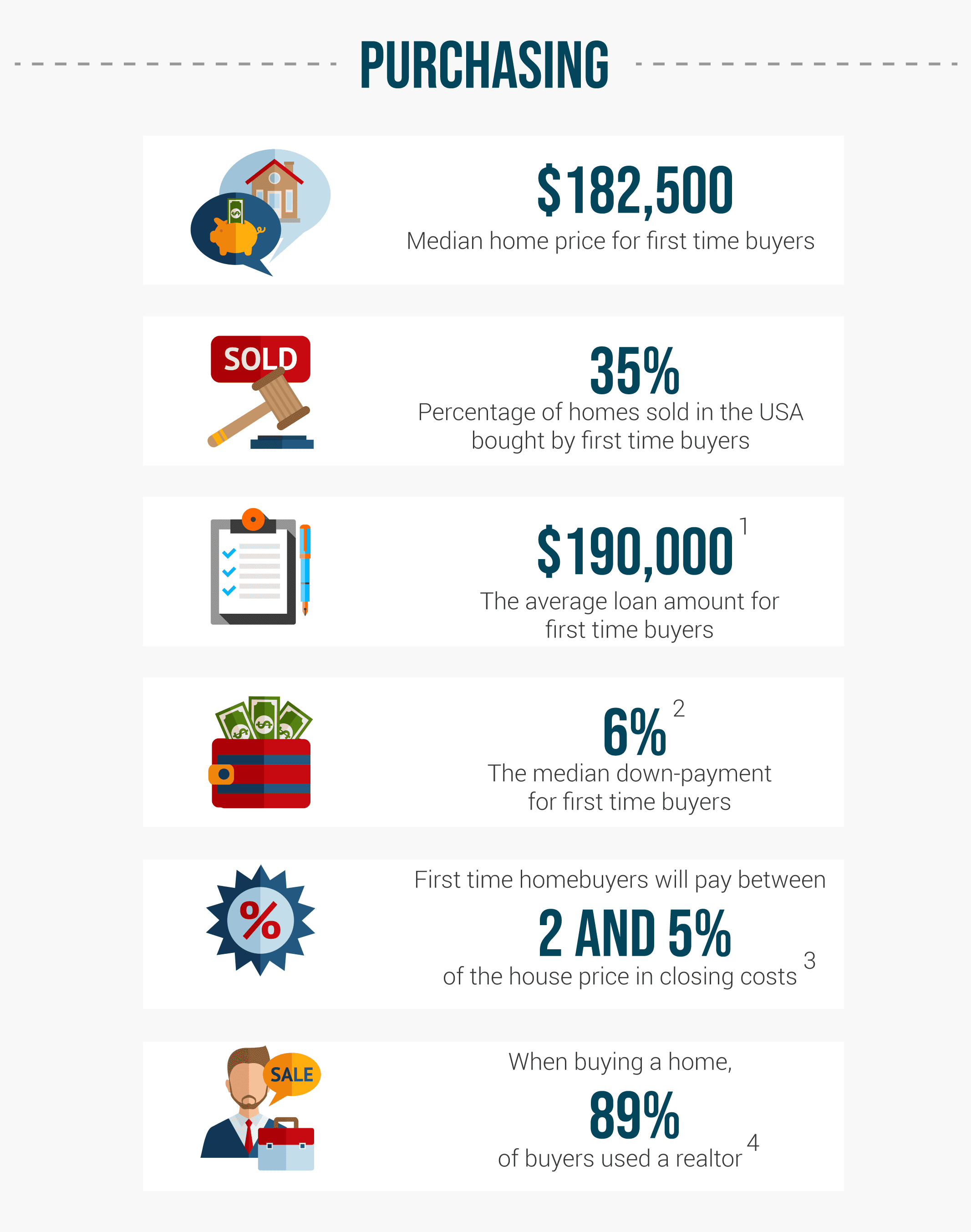

How much do most first-time home buyers usually put down?

Most first-time home buyers put down between 3% and 10% of the home’s purchase price. Conventional loans often allow as little as 3% down, while FHA loans require at least 3.5%. Some buyers may put down more to lower their monthly payments, while VA and USDA loans offer zero-down options for eligible buyers.

What Are the Benefits of Being a First-Time Home Buyer?

First-time home buyers can take advantage of low down payment options, government-backed loans (FHA, VA, USDA), and down payment assistance programs. Many states offer grants and tax credits to make homeownership more affordable. Additionally, lower credit score requirements and reduced interest rates help new buyers secure favorable loan terms. Programs like FHA loans allow 3.5% down payments, making homeownership more accessible.

How Much Down Payment for a $300K House First-Time Buyer?

The required down payment depends on the loan type. An FHA loan requires 3.5% down, which is $10,500. A conventional loan may require 3% down ($9,000) or 5% ($15,000), while VA and USDA loans require 0% down for eligible buyers. First-time buyers should also budget for closing costs and moving expenses, which can add an extra 2-5% of the home price.

How Much Should a First-Time Home Buyer Save?

A first-time home buyer should save for a down payment, closing costs, and emergency expenses. If using an FHA loan (3.5% down) for a $300,000 home, you’d need $10,500 for the down payment alone. Closing costs typically range from 2% to 5% of the home price, adding $6,000 to $15,000. Having three to six months of living expenses saved for unexpected costs is also recommended.

How Much Do First-Time Home Buyers Have to Put Down in California?

In California, first-time home buyers can often put down as little as 3% for conventional loans or 3.5% for FHA loans. Some state and local programs offer down payment assistance to reduce upfront costs. VA and USDA loans may require no down payment. However, in California’s competitive market, a larger down payment can make offers more attractive to sellers.

Can I Qualify as a First-Time Home Buyer Again?

Yes, you can qualify again as a first-time home buyer if you have not owned a home in the past three years. Some loan programs, such as FHA and state-specific assistance programs, allow previous homeowners to regain first-time buyer status if they meet certain criteria. If you’ve recently sold a home but haven’t owned one in three years, you may still be eligible for down payment assistance and tax benefits.

How do I Apply for the $25,000 First-Time Home Buyer Grant Application?

As of January 2025, the $25,000 Downpayment Toward Equity Act has not been enacted into law, so applications are not currently being accepted. This proposed legislation aims to provide first-time, first-generation homebuyers with up to $25,000 in financial assistance for down payments and closing costs. Eligibility criteria include being a first-time homebuyer, meeting specific income limits, and purchasing a primary residence.

Does Co-Signing Affect First-Time Home Buyer Status?

Yes, co-signing a mortgage loan can impact your first-time home buyer eligibility. If your name is on another home loan, some programs may not consider you a first-time buyer, even if you don’t live in the home. However, if you haven’t owned a home in three years, some programs might still classify you as a first-time buyer, but lenders may factor the co-signed loan into your debt-to-income ratio (DTI).

Final First Time Home Buyer Considerations

Today there are more mortgage loans available, and the lending criteria is less strict. You need to look closely at your finances and your needs to determine which kind of loan is the best choice for you. If you are considering loan with monthly mortgage insurance, you will need to factor that into your proposed housing expenses and find out if PMI is tax-deductible with your personal circumstances. For most Americans, the 30 year fixed loan is the most popular, and FHA first time home loans allow many millions more Americans to become homeowners. Prospective first-time homebuyers have the option to apply for the best first time buyer mortgages and home buying grants either through online platforms or in physical locations. Mortgage companies are equipped to grant first-time buyer program approvals within a matter of minutes, so do your research and become a homeowner.

References

- Hat-tip to RedFin for the Graph., First Time Home Buyer’s Guide. (n.d.).

- 12 Tips for Getting the Most out of a Home Inspection

- The RefiGuide offers guides by states as well. These are Popular States for First Time Home Buyers :

- Arizona

- California

- Florida

- Nevada

- Texas