The HELOC loan is one of the most cherished and powerful financial tools for homeowners in the United States. In 2025 mortgage rates are nearly double what they were three years ago which makes the home equity line of credit, also known as a HELOC the best opportunity for homeowners to get quick access to cash without having to refinance their low interest mortgage.

We created this HELOC loan guide to help homeowners learn about the pros and cons of home equity credit lines so you can apply with the best HELOC-Lenders to secure the low 2nd mortgage rates available that meet your financial needs. F

What Is a HELOC Loan?

The HELOC loan is an acronym for the term “home equity line of credit.”

The HELOC is a revolving line of credit and lenders approve a specific amount that is relative to the amount of equity you have earned with your home according to a licensed appraiser.

HELOC loans are only available to homeowners that request a junior lien on against their property with a home equity lender.

The HELOC is a highly touted financial tool that enables homeowners to access funds by using their home equity as collateral. Because HELOC rates are typically lower than credit cards, homeowners often choose this cost-effective option for debt consolidation and home improvement projects.

HELOC loan programs offer interest-only payments during the draw period, which usually lasts several years. The HELOC is a great alternative to getting a refinance with cash out.

What Are the Pros and Cons of a HELOC Loan?

Should you get a home equity line of credit in 2025? Maybe! Here are some HELOC advantages and disadvantages:

HELOC Pros

- Lower interest rate and payment at first

- Save money and time compared to refinancing your first mortgage

- Reduce monthly payments with debt consolidation

- Draw out only the money you need – save interest

- You can draw down the HELOC and repay as many times as you wish

- Lower rate over loan’s life than a first mortgage usually

- You can use the money for whatever you wish

- Interest is usually tax deductible (Check 2025 Home Equity Tax Deduction Rules)

HELOC Cons

- The HELOC rate is usually variable. Your interest rate can go up

- Monthly payment can go up a lot when you have to start paying principal

- Extra fees and closing costs are common – check your paperwork carefully

- HELOC is secured by your home, so if you don’t make your payments, the bank can take your house.

How Long Does It Take to Process a HELOC?

The processing time to fund a HELOC can vary widely. Some HELOCs process quickly. When the borrower submits a completed HELOC loan application the timeline starts. Being organized and working with the right lenders are the driving forces how long the HELOC process takes. The HELOC process ranges from 2 to 7 weeks depending on all the factors. Learn more about, How long it takes to get a HELOC.

The process includes application review, credit check, property appraisal, underwriting, and closing. Some lenders offer expedited approvals in as little as 10 days, especially for highly qualified borrowers with high credit scores and significant home equity. Delays may occur due to incomplete documentation, complex property evaluations, or lender backlog. To speed up the process, ensure all required financial documents and property details are submitted promptly.

Apply with Top HELOC Lenders for Today’s Lowest Rates

Is the value of your home rising? Do you have at least 10 to 20% equity?

Then you may be thinking about tapping some of your hard-earned money with a home equity line of credit, or HELOC.

If so, please use this article to guide you in applying for a competitive HELOC loan for 2025.

The tax deduction laws on HELOCs and equity loans were recently changed so it is important to get up to speed on all the changes.

Understanding HELOC Loan Types

There are two types of home equity credit lines:

- Adjustable or variable rate: Your interest rate can be changed ad may increase. This can be on a monthly, semiannual or annual basis. It will fluctuate based upon future changes in the index rate the mortgage lender uses, such as LIBOR or the prime rate. Your payment each month is based upon the amount outstanding and the current interest rate. You will be paying down the balance bit by bit each month. Many savvy homeowners refinance the HELOC when the variable interest rates begin to rise. In most cases, the borrowers will refinance the HELOC into a fixed rate home equity loan program.

- Interest only: The rate on this type of home equity line of credit also can fluctuate. But you are paying interest only payments during the 5-10-year draw period. The interest only payments keeps your payment low, but you are not paying down the principal until the draw period ends and you start the HELOC repayment period.

Home Equity Loan Versus a HELOC

The HELOC loan is a variable interest line of credit based upon the amount of equity in the home. The lender will give you a HELOC with a certain line of credit, such as $25,000. With the equity line of credit, you can draw that money out of the property whenever you wish, either in small increments or all at once. On the other hand, when an equity loan funds, the borrower receives the money for the entire loan amount all at once. What is a home equity loan?

Checking the Current HELOC Interest Rates

Your interest rate will be based upon the underlying index rate. This could be the monthly or the six-month LIBOR, or the prime rate. On top of that, there will be a margin between 0-3.25%. Some HELOCs may feature a minimum interest rate; most home equity credit lines also have a ceiling rate that it cannot rise above

Some line of credit HELOCs feature a low, intro interest rate; this is called a teaser rate. It may be lower than the current rate for your first mortgage. But the HELOC rate will go up at the end of the introductory period. It then becomes an adjustable rate that can go up for the rest of the loan’s term. Talk to lenders and compare the current HELOC rates today from trusted home equity lenders.

What are Today’s HELOC Rates?

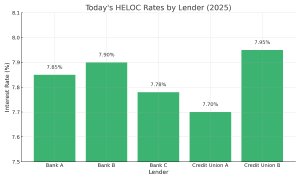

Generally, home equity loans offered by banks, credit unions and mortgage bankers offer quite low HELOC rates. We recommend that you contact at least three lenders when looking for the best HELOC. The current HELOC interest rates are about a point and a half higher than traditional 30-year mortgage rates.

Frequently Asked Questions for HELOC Loans

How is HELOC interest calculated?

HELOC interest is typically calculated based on the outstanding balance using a variable rate, often tied to the prime rate plus a margin set by the lender. To calculate HELOC interest, use the formula: (Outstanding Balance × Interest Rate) ÷ 12 months. For example, if you borrow $100,000 at a 6% annual interest rate, the monthly interest payment would be ($100,000 × 0.06) ÷ 12 = $550. Keep in mind that HELOCs often have variable interest rates, so the rate may fluctuate over time. Reviewing your lender’s terms and tracking interest rate changes can help you accurately estimate monthly payments and overall costs.

Can I increase my HELOC limit?

Yes, you can request a credit limit increase from your lender, but approval depends on factors like your equity, credit, and income.

In most cases, the home equity line of credit features a variable rate tied to the prime index. However, many lenders are offering a fixe rate conversion option in 2025.

Can you have two HELOCs at the same time?

Yes, you can have multiple HELOCs, but each requires lender approval, and lenders may limit borrowing based on equity and risk.

Do HELOCs compound interest?

HELOCs typically use simple interest, calculated daily on the outstanding balance, though terms can vary by lender.

Can I use my HELOC to buy another house?

Yes, you can use HELOC funds for a down payment or even to buy a property outright if there’s sufficient credit available.

Can I get a HELOC with bad credit?

Yes there are many private money and 2nd mortgage lenders that offer bad credit HELOCs to borrowers that have substantial equity or a low loan to value ratio.

Can I get a HELOC after Chapter 7 discharge?

It may be possible, but lenders usually require a waiting period after bankruptcy (typically two to four years) and proof of re-established credit.

How to pay off a HELOC quickly?

Pay more than the minimum payment, make biweekly payments, or refinance if possible. These can help reduce the balance faster.

Is HELOC repayment a fixed rate period?

In most cases, the HELOC interest rate continues to feature a variable interest rate. However many lenders are beginning to offer a fixed-rate HELOC conversion option.

What is a DSCR HELOC?

A DSCR HELOC, is an acronym for Debt Service Coverage Ratio Home Equity Line of Credit. This is a unique HELOC designed for real estate investors because it assesses a property’s DSCR to gauge the borrower’s repayment capability. DSCR HELOCs are tailored for financing income-generating properties and are not suitable for purchasing primary residences or fixer-uppers.

How long does a HELOC take to fund after closing?

Funding typically occurs within a few days to a week after closing, depending on the lender.

What documents are needed for a home equity loan?

Common documents include proof of income, credit history, tax returns, property appraisal, and details of existing debts.

Can I use a HELOC on an investment property?

Yes, HELOC funds can be used for investment property down payments, though some lenders may restrict this.

Can you get a HELOC without income verification?

There are some no doc HELOC lenders may offer limited-income verification HELOCs, but they may require higher credit scores and equity levels.

Can You Get a HELOC on a Commercial Property?

Yes, some lenders offer HELOCs on commercial properties, but they are less common than residential HELOCs. Approval depends on factors like equity, property type, rental income, and borrower creditworthiness. Loan-to-value (LTV) ratios are typically lower (50%-70%), and interest rates may be higher due to increased risk. Alternative financing options include business credit lines or commercial equity loans.

How Does a HELOC Affect Your Credit Score?

Of course taking out a HELOC can affect your credit scores in several ways. When you apply, banks and mortgage lenders perform a hard inquiry that may slightly lower your score. Once opened, a HELOC appears as a revolving credit line, impacting your credit utilization ratio and overall credit mix. Keeping your balance low and making on-time payments can help improve your score over time, while high utilization or missed payments can negatively affect it. With all of this being said, don’t overact because if you make your monthly payment on time. a home equity line of credit is actually great for your credit.

Who are the Top HELOC Lenders in California?

Some of the best HELOC lenders in California include Bank of America, Figure, U.S. Bank, LoanDepot and Spring EQ. These lenders are known for competitive rates, fast approvals, and flexible credit requirements. California borrowers can also consider local credit unions and regional lenders that offer rate discounts for members or autopay. Always compare interest rates, closing costs, and draw periods before choosing the lender offering the best HELOC loans for your financial goals.

Can You Get a HELOC on a Mobile Home?

Getting a HELOC on a mobile home is possible but difficult. Most lenders require the home to be permanently affixed to land and classified as real property rather than personal property. Borrowers must own the home and the land, and some lenders may impose minimum age and foundation requirements. Specialized lenders may offer more flexible options.

Can You Get a HELOC on a Manufactured Home?

Yes, but strict conditions apply. The manufactured home must be permanently affixed to a foundation, classified as real property, and meet HUD standards. Lenders also require the land to be owned, not leased, and may have age restrictions on the home. Borrowers should check with lenders specializing in manufactured home financing for eligibility.

Can You Get a HELOC with a Tax Lien?

Getting a HELOC (Home Equity Line of Credit) with a tax lien is difficult but not impossible. Most lenders require a clear title, meaning the lien must be paid off or subordinated before approval. Some lenders may allow a HELOC if the borrower has a payment plan with the IRS and sufficient equity. However, expect higher interest rates and stricter terms due to the added risk. Consulting with a lender about specific eligibility requirements is recommended.

Can You Get a HELOC on a Condo?

Yes, you can get a HELOC on a condo, but approval depends on factors such as the condo association’s financial health, owner-occupancy ratio, and lender policies. Lenders may impose stricter requirements than on single-family homes, including a lower loan-to-value (LTV) ratio. FHA or VA-backed condos may have additional restrictions. It’s best to check whether the condo development is approved by the lender before applying.

Can You Get a HELOC on Land?

Yes, but it’s more challenging. Most lenders do not offer HELOCs on vacant land since land is riskier collateral than a home. If available, lenders usually require significant equity (50% LTV or lower), a strong credit score, and proof of income. HELOCs on land are more common for improved lots (ready for construction) rather than raw land. Borrowers may need to explore land loans or alternative financing options.

Can I Open a HELOC and Not Use It?

Yes, you can open a HELOC and not use it, similar to a credit card. Many homeowners open a HELOC as a financial safety net, giving them access to funds when needed. However, some lenders charge annual fees or inactivity fees if the HELOC is not used. The credit line availability can also change based on market conditions. It’s best to understand the terms and costs before opening a HELOC without immediate use.

Can You Get a HELOC on an FHA Loan?

Generally, FHA loans do not allow HELOCs, as FHA mortgages are government-backed with stricter secondary financing rules. However, borrowers with substantial equity can refinance into a conventional loan to qualify for a HELOC. Alternatively, FHA borrowers may explore an FHA cash-out refinance to access home equity. Some lenders offer second mortgage options, but these often come with stricter credit and loan-to-value requirements.

Can You Refinance a HELOC into a Mortgage?

Yes, a HELOC can be refinanced into a mortgage, often done to lock in a fixed interest rate and lower monthly payments. Borrowers can refinance through a cash-out refinance, a home equity loan, or a conventional mortgage that consolidates the HELOC balance. Lenders will assess credit score, debt-to-income ratio, and equity before approval. This strategy is ideal when HELOC interest rates rise or repayment terms become unaffordable.

Is HELOC Better Than Home Equity Loan?

A HELOC provides a revolving credit line with variable rates, ideal for ongoing expenses like home improvements. A home equity loan offers a lump sum with fixed rates, better for specific costs with steady payments. Choose based on whether you need flexibility or predictability. Both use your home as collateral, so consider foreclosure risks. Check tax-deductible interest for home improvements.

Is a HELOC Better Than a Personal Loan?

HELOCs typically have lower rates as they’re secured by your home, but defaulting risks foreclosure. Personal loans are unsecured, have higher rates but don’t risk your home, offering safety. Choose HELOC for lower costs if you have equity; opt for personal loans to avoid home risk, especially for fixed, one-time expenses.

Can I Use a HELOC as a Bridge Loan?

Yes, you can use a HELOC as a bridge loan to buy a new home before selling your current one, offering flexibility. However, traditional bridge loans, designed for this purpose, may have better terms. Consider interest rates, fees, and repayment. Read Bridge Loans vs HELOC.

Minimum HELOC Credit Score Requirements

You need decent credit to be approved for a home equity loan. Most home equity lenders give the best rates to people with at least a 700-credit score.

However, you may qualify if your credit is between 620 and 699. Your rate will be higher and the repayment term may be shorter.

If you a credit score below 600, you will need to have at least 25% equity.

Most home equity brokers want a DTI of 40% to 43%. If you have a credit score under 700, having a low DTI may get you approved faster.

Another factor with a lower credit score is how much equity is in the home. Many HELOC lenders want at least 20% equity to borrow money. But if your credit score is well below 700, having more equity will assure the lender that you will pay it back.

The more equity in the home, the less lender risk. Most people are more likely to pay a loan when they have a lot of equity in the home. Remember if you don’t make the payments on time, the lender has the right to foreclose.

How Does an Interest Only HELOC Loan Work?

A home equity line of credit or HELOC is a very convenient and flexible way to borrow the equity in your home.

A home equity line of credit or HELOC is a very convenient and flexible way to borrow the equity in your home.

A HELOC loan can be a good financial decision if the loan is managed in a prudent way.

If you do not do so, however, a home equity line can cause you financial headaches.

Most home equity credit lines allow you to write a check to finance home improvements and contractors.

To help you to get an interest only home equity line of credit and manage it well, we have prepared the following guide.

How to Calculate the Monthly Payment for a Home Equity Line of Credit (HELOC)

Borrowers can employ the subsequent two-step method to determine their monthly home equity line payments:

A = P(1+rt)

A = Principal + Interest.

P = Principal.

R = Rate.

T = Time (in years)

Then, take the total amount (A) and divide it by the number of months.

A / # of months = monthly payment.

What is the Loan to Value Requirement with HELOC Line Accounts?

You have to have enough equity to support the combined LTV or loan to value of your first mortgage plus your home equity line of credit. Most mortgage lenders allow a maximum combined loan to value of 80%.Let’s say your property is worth $200,000. If the balance on your first mortgage is $100,000 and you get a $60,000 home equity line of credit, your combined loan to value is 80%.Most traditional lenders only allow an 80% LTV combined. Some states also have laws that limit your loan to value at 80%. Some HELOC lenders may allow 90% to 100%. It pays to shop for the best HELOC because lenders have different LTV requirements!

The most important part of a HELOC is your loan to value. You need to have a very good grasp of what your home is worth today before you even apply. You can review sites such as Zillow, Redfin and Realtor.com to get an idea of what your home is worth. When you make the application, the lender will order a new appraisal. This costs you money. So, it is very important to know up front what the home is likely worth so you know if it is even worth applying. When shopping for the best HELOC lenders and brokers, don’t forget to ask them what the LTV requirement is for HELOCs. Ask the broker or lender if they will waive the HELOC appraisal requirement.

What Is the Minimum Credit Score Is Needed for HELOC Credit Lines?

If you have a lower credit score, the lender may put more emphasis on your debt-to-income ratio or DTI. Your DTI measures your total monthly debt payments compared to your gross monthly income.

Many homeowners need money quickly, and a bad credit home equity loan seems like the perfect solution for a borrower with less than perfect credit. However, many homeowners have low credit scores and are unable to qualify for a home equity credit line from their local Credit Union or Bank. In those instances, borrowers should consider a hard money loan or non-prime equity loan. Both options require some equity, but they both all low credit scores.

Does a HELOC Hurt your Credit Score?

When it comes to your credit, a HELOC revolves like a traditional credit card. Of course when you initially apply for a line of credit HELOC, it could temporarily impact your credit score.

However, if you are delinquent on a HELOC payments for over 30 days its can dramatically lower your credit score. If you have leave unpaid revolving debt sitting on your line of credit, it can also reduce your score as that minimizes your total available credit.

How Much of a Home Equity Line of Credit Can You Afford?

Most HELOCs consist of a draw period and repayment period.

Most HELOCs consist of a draw period and repayment period.

The majority of home equity lines of credit today are 20 or 30-year loans and have a 10-year draw period.

If you have a 30-year HELOC loan and a 10-year draw, you cannot draw cash from the home equity line after 10 years pass.

You then must pay down your balance in the next 20 years.

Be aware of some equity lines of credit that have a balloon payment at the end.

This is a feature of some interest only home equity credit lines.

You would then be required to pay a large lump sum payment at the end of the loan.

For instance, if you have a 15 year, interest only HELOC line with a balance at the end of $25,000, you need to pay all of that at the end of the 15th year.

It is important for you to understand all of the risks of a home equity line before you sign the paperwork.

People who own their home today are most likely enjoying an increase in their equity position. Home prices are going up and homes are appreciating in value. This increases the equity that a home owner has in the home. It also means that the owner can pull some of that equity out of the property and do some remodeling.

One of the most popular instruments used today to do home remodels is a home equity line or credit. The home equity line of credit is a second mortgage that you get while leaving the first mortgage in place. A HELOC is used to take equity out of the home up to a certain amount; the maximum amount varies by mortgage lender and by state. Some situations allow the home owner to pull up to 80% of the home’s value out, while others may allow 85% or 90%.

For some, a home equity loan may be a safer bet, as you know exactly what the payments will be and when the loan will be paid off. Remember, your home is your most important asset, and you never want to put it at risk. Are there really $0 interest home improvement loan programs?

Why Is a Home Equity Line of Credit so Valuable to Homeowners?

A HELOC can be a wise financial tool when you use it to improve your house while raising the property value. A HELOC is a second mortgage that is also often referred to as a home equity loan.

The difference between a HELOC and a traditional home equity loan is that you are not borrowing an exact, set lump of cash.

You are instead getting a line of credit that you may draw from as you wish.

For instance, you might be approved for a $50,000 home equity line of credit. But you might decide that right now you only need to pull out $10,000.

This would leave you with $40,000 on your home equity line of credit that you can use later if you like.

You also may pay off the equity line of credit as you like, and pull money out again as well, up to your approved line of credit. You can do this as many times as you wish.

In many ways, a home equity line of credit works exactly like a credit card, but your ‘credit line’ is your home’s equity.

It’s a Good Year for Homeowners to take out a HELOC Loan as Rates are Low and closing costs are minimal, in most cases.

As with a home equity loan, an equity line of credit uses your home as the loan’s collateral. You can use the line of credit for many things – home renovations, paying off credit cards, or taking out a HELOC for buying an investment property, for example.

A HELOC loan can be a good choice for you if you have equity you want to draw out, but you do not want to refinance your first mortgage. Refinancing a first mortgage is expensive, takes time, and isn’t a good choice if you have a low interest rate. Before signing the paperwork for a line of credit HELOC, make sure there is no annual fee and no pre-payment penalty. Don’t forget you are permitted to refinance a home equity line of credit if the interest rates improve.

Setting Up a HELOC Account

If you own your home, you may not continue to enjoy rising home values in 2024.

With higher home prices and rock bottom low interest rates, a good option for many home owners today is to open a home equity line of credit.

HELOC loans are variable interest credit lines that uses some of your home equity to pay for things you want or need.

Home equity lines can get a good financial move for people who are OK with variable rate interest payments.

It also can be a good idea if you have smart uses for the money.

Not everything should be paid for with a HELOC. So, are ready to write checks with your HELOC loan?

Takeaway on How to Get a HELOC in 2025

Getting a HELOC loan is a great way to get the money that you need to fund things that you want or need. The interest rate on an equity line of credit is low, but it can rise with time. Also keep in mind that after the draw period ends after 10 years, you have to start paying interest and principal.

Most home equity credit lines have only interest payments at first. But if you have a smart use for the money that will ideally make you money or pay off high interest debt, a flexible HELOC that converts to a fixed rate makes sense. Learn more about how a home equity credit line works and speak with the best HELOC lenders that offer the credit that meets your needs.