More and more renters are considering home-ownership. Banks and mortgage lending companies have announced new finance options for first time home buyers. In many instances, the guidelines have been loosened and the credit rules have been eased. This year appears to be a great year for consumers to stop renting and make the plunge to home-ownership in the United States. This article will help you learn about how you need to get prepared before applying for a first time home buyer mortgage.

Everything You Need to Know About Being a First Time Home Buyer

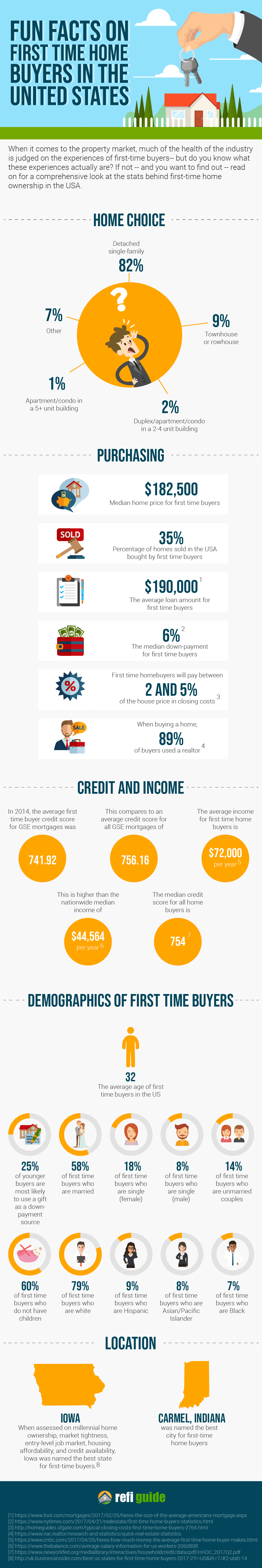

With today’s low interest rates and rising property values, more renters are thinking about becoming homeowners. Many mortgage lenders and banks recently announced new mortgage finance loans for first time buyers. In some cases, mortgage underwriting standards are getting looser and credit rules are easier than a few years ago. For this year, it seems that more consumers will have the option to stop renting and buy a home in the US. Take a look at a this visual presentation for more incredible first time home buyer facts.

What Types of Homes First Time Buyers Purchase

Current statistics show definite trends in the types of dwellings Americans buy with a mortgage:

- Detached, single family home: 82%

- Townhouse or row house: 9%

- Other: 7%

- Apartment or condominium in 5+ unit building

- Duplex/apartment/condo in 2-4 unit building

Learn how to get pre-qualified for a first time home buyer loan.

Most Popular First Time Buyer Mortgage Programs

It is easier today than a few years back to get a home loan as a first time home buyer. The federal government has several programs it supports to encourage homeownership for people with past credit and finance problems. The most popular first-time buyer programs are:

Federal Housing Administration (FHA)

FHA loans help more first time buyers than any other program. The underwriting guidelines to qualify for these loans are more flexible than conventional loans. The US government guarantees the loan will not default if you fail to pay. So, FHA-approved lenders are more likely to extend credit to borrowers with less than perfect credit.

If you have a 580+ credit score, you only need to have a 3.5% down payment, and if your score is lower, you still need just 10% down. In either case, you can get down payment funds as a gift from a friend or relative.

Another benefit of the FHA program is closing costs are rolled into the loan, greatly reducing your out of pocket expenses.

This program has no income restrictions, meaning you can qualify for an FHA even with a higher income. You will need to show the lender that you have recovered financially. Ideally, you need to show that you have been paying bills on time for the last year. Financial stability matters more to FHA than credit score.

HUD First Time Home Buyer Programs

HUD offers a variety of first time home buyer grants in most states, if you meet income and other restrictions and qualifications. Also, review your local county website for additional information on local first time home buyer programs. Many counties and localities also offer down payment assistance for first time buyers. You may also qualify for grants for closing costs that can almost eliminate your out of pocket costs to close the loan.

US Department of Agriculture (USDA) Loans

This home loan program is a good fit for low to moderate income, first time home buyers in rural parts of the US. If you want to buy a home that is in an eligible location according to USDA and make a low to moderate income, you may qualify for this program.

One might think that only small towns and rural areas would qualify for these loans, but almost 97% of the US land mass is in a location that is eligible for a USDA loan. USDA home financing is great for the first time buyer because you can get 100% financing. This is especially attractive for the first time buyer because coming up with a down payment is one of the greatest challenges when you have never owned a home before.

USDA financing is also desirable because mortgage insurance is cheaper than FHA loans. Note that you generally need to have a 640 credit score to qualify, however.

Veterans Administration (VA) Loans

The VA has an excellent mortgage program for most active and retired military veterans. VA loans can be had with 100% financing, and there is no minimum credit score. There also is no mortgage insurance. This is a great program for the first time buyer who is active or retired military.

Conventional 97% LTV Loans

Fannie Mae and Freddie Mac are government sponsored entities that offer a secondary market to purchase mortgages. Both GSEs have a mortgage program that can help first time buyers get their first home. This program offers a 3% down payment option, and the down payment can be a gift from a friend or relative. Credit scores need to be in the 620s to 640s to qualify. This is a good option for a first time buyer given the low down payment requirement.

First Time Home Buyer Tips

Buying a home for the first time with a purchase money mortgage can be stressful. You can relieve the stress by following these easy tips.

Save for a down payment early

While it is common to put down 20%, this is not necessary for most first time home buyers. FHA requires only 3.5%, and some conventional loan programs offer 3% down payments. If you put down less money, you will pay more in interest and will probably have to pay for private mortgage insurance. But even putting down 3% on a $200,000 home is $6000, and you also need to cover closing costs, which can run from 2% to 5% of the loan amount. So, the earlier you start saving, the better.

Explore state and local assistance programs

There are federal programs to help you buy a home for the first time, such as the FHA program. But many states also have mortgage and down payment assistance programs for the first time home buyer. You may also qualify for closing cost help, tax credits and lower interest rates.

Check your credit

When you apply for a loan, your credit score will be a vital factor in your approval. It will decide your interest rate and the terms. So, check your credit score before you start to shop for a loan or a home. File a dispute with the credit bureaus that could be hurting your credit score. Look for chances to boost your credit, such as paying down debt. Also, do not apply for new credit after you have applied for a loan, as this will decrease your credit score.

Compare mortgage rates

It is common for home buyers to only check one lender for mortgage rates, but you could end up paying more. It is recommended to check rates with at least three lenders, as this can save you several thousand dollars over the first five years of your loan, according to the Consumer Financial Protection Bureau.

Get a mortgage preapproval letter

As you get closer to buying a home, you should get preapproved by the lender you have chosen. This is where the lender checks your credit score, reviews your financial documents, and approves you for a loan up to a certain dollar amount. This is helpful for you as you know how much home you can afford when you go house hunting. Also, it shows home sellers and agents that you have the ability to close a loan.

Stick to your budget

It is wise to look at homes that cost less than your maximum approval amount. Always remember that with homeownership comes maintenance costs. Shopping with a budget in mind that is well below your maximum loan amount will reduce financial stress down the road.

If you are in a hot real estate market with low inventory, you could be tempted to get into a bidding war on a house you love. It is unwise to overpay on a house in this situation; you will be saddled with a higher mortgage for decades, potentially, and this can be financially draining to say the least. Don’t allow your emotions to dictate vital financial decisions. Do not pay more for a house than it is worth.

Remember closing costs

Closing costs will run from 2-5%, so it is important to save for these in addition to your down payment. You can do some shopping and compare prices for some closing costs and expenses, including homeowners’ insurance, title searches and home inspections. If the seller needs to move the home, you can ask if they will pay a portion of your closing costs. Another option is to talk to the agent about lowering their commission.

Save for move-in expenses

After you have done all that saving for closing costs and down payment, you might think your job is done. Actually, you should also have some money saved for move-in expenses, such as new furniture, updating fixtures, flooring, paint and any minor upgrades you want to do when you move in.

Buy a home that fits future needs

Many first time buyers buy a home that fits their needs right now. But if you want to have a family, it could be wise to buy a home that is larger today so you have room to grow. Consider your needs in the future and decide if the home you want to buy will suit those needs.

Try to negotiate the price

Remember much of the home buying process is not set in stone. If you find a house you love, see if you can get it for less than the asking price. Or ask the seller to cover a major repair, or give you a credit adjustment at the closing table. Will the seller pay for some of your closing costs? If you are in a slow market, you may discover the seller is willing to deal to get the house sold.

A home inspection is vital but it may not tell the whole story

After you make an offer that is accepted, you should pay for a home inspection to look at the condition of the home inside and out. But a home inspection may not tell you everything:

- Not every home inspector will look for mold, pests or test for radon. Know what is included in your home inspection.

- Check that the home inspector can get into every part of the home, such as the basement, attic and roof.

- Be at the inspection and watch closely what the inspector does.

- Never be afraid to ask the home inspector to look closer at something.

- Carefully review the home inspection report and look for any major problems or repairs that are needed. You do not want to spend a lot of money on a home and be hit with major repairs as soon as you buy it. A home inspection report is a vital tool in your home purchase decision, so be sure to use it.

Home Purchasing Facts for First Time Buyers

- Median home price for first time buyers: $182,500

- Percentage of homes that were sold in the US bought by first-time buyers: 35%

- Average amount of loan for first time buyers: $190,000

- Median down payment for first time buyers: 6%

- First time buyers pay from 2% to 5% in closing costs

- When buying their home 89% of first time buyers use a realtor

Credit and Income for First Time Buyers

- In 2014, the average first-time buyer credit score was 741.

- This compares to average credit scores for all buyers of 756.

- The average income for the first time home buyer is $72,000.

- The nationwide median income is $44,560.

- Median credit score for all home buyers is 754.

Demographics of First Time Buyers

- The average age of the first time buyer in the US: 32

- 25% of young buyers usually use a gift for a down payment source

- 58% of first-time buyers are married

- 18% of first time buyer females are single

- 8% of first time buyer males are single

- 14% of first time buyers are unmarried

- 60% of first time buyers do not have children

- 79% of first time buyers are white

- 9% of first time buyers are Hispanic

- 8% of first time buyers are Asian/Pacific Islander

- 7% of first time buyers are black

Location of Most First Time Buyers

- Iowa: When assessed in terms of millennial homeownership, market tightness, the entry-level job market, affordability of housing and availability of credit, Iowa has been named the best state for first time home buyers.

- Carmel, Indiana: Named recently as the best city for first-time homebuyers.

Buying a home for the first time is exciting. If you keep in mind all of the information contained in this first time home buyer’s guide, you should be able to make a wise buying decision.