Buying a house can be a stressful time, so it is important to be organized and understand what the credit score requirements are up-front for the various mortgage programs in the United States in 2025. Read on to see what home financing programs are available and what the minimum credit scores for home loas set by the banks and lenders, before making an offer on a house.

Borrowers Want to Know What Credit Score They Need to Qualify for a Home Mortgage in 2025

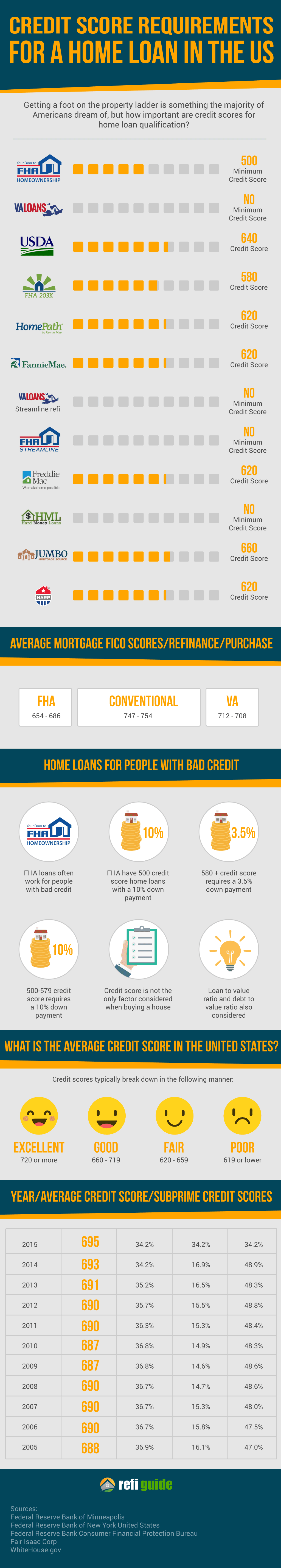

Credit scores are a fundamental aspect of the homebuying process, influencing your eligibility for various types of mortgages and the terms offered by lenders. While specific credit score requirements can vary, maintaining a good credit score, managing debt responsibly, and addressing any credit issues can significantly enhance your ability to buy the home of your dreams.

Credit score requirements may vary whether you are applying for FHA, VA, USDA, Fannie Mae, Freddie Mac, Non QM, portfolio, hard money or conventional mortgage programs. It’s essential to understand the credit score requirements for the home loan you’re seeking and take proactive steps to strengthen your credit profile to achieve your homeownership goals.

Embed this image on your site (copy the code below):

Credit Score Requirement Information

Buying a home can be a stressful experience, especially if you are concerned about your credit score and qualifying for a long. But lending criteria in recent years have become more flexible, so you may be in better position than you think the obtain a mortgage. We will help you find an answer to the question, “What credit score do I need to buy a home in 2024.” Keep reading to discover which home financing programs are available and what the credit score requirements are for each.

FHA loans, backed by the Federal Housing Administration, provide assistance to many first time home buyers with less than perfect credit. Technically, the minimum credit score for FHA is 500, but most mortgage lenders impose their own minimum credit score. For people who want to get an FHA mortgage with only a 3.5% down payment, you will need to have at least a 580 credit score to be considered. If you have a credit score below 580, you still can get a loan; you will just need to come up with a bigger down payment. See also FHA cash out refinance programs.

Expect to need to come up with a 10% down payment with a score below 580. (hud)

Clearly, Federal Housing Administration provides a very easy credit qualification criteria. Here are some other good reasons to make FHA your first choice:

- Easier to qualify: The mortgages are backed by FHA, so lenders are willing to lower their lending standards for people with less than perfect credit and lower credit scores.

- Low interest rates: Many FHA borrowers are shocked to discover they can get a low interest rate even with subpar credit. This is because FHA guarantees the loan against default.

- Lower fees: There are lower closing costs and lower payments for mortgage insurance.

- Bankruptcy and/or foreclosure ok: Just because you filed Chapter 7 or had a foreclosure a few years ago does not mean you cannot get FHA financing. If you can show FHA that you have reestablished your credit and have a good payment history for the last 12 months, you may be able to qualify.

- No credit score ok: Even if you do not have any credit history, you may be able to qualify for a no credit score home loan with proof of on time rental and utility payments.

The Department of Veterans’ Affairs offers low interest loans to active military and veterans who qualify. There is no exact minimum credit score requirement set by the VA to qualify for a VA loan, but note the VA does not make the loan. So, there is actually no minimum credit score governed by the VA per se. Mortgage lenders approved by the VA will usually have a minimum credit score to consider you for a loan. That number varies from lender to lender, but a 620 credit score is often considered the minimum requirement for many lenders. (military)

Also, the VA-approved lender will look at your past credit patterns and payments to determine your likelihood to pay on time. A borrower who has been making payments on time for the last 12 months generally is believed to have shown a willingness to repay their debt obligations in the future. On the other hand, if you have regular late payments and judgments in the past 12 months, you are more likely to be turned down for a VA loan.

Also, if you have no credit history, many VA-approved lenders will not consider you for a loan. It is recommended to establish at least one or two lines of credit and pay them on time for a year before you apply for a VA loan. Otherwise, consider the FHA loan program.

The VA loan program is a great choice for military members and veterans. It features below market rates, low closing costs and no private mortgage insurance. You also can get a 100% down payment option.

USDA loans are intended for lower income and credit score borrowers who intend to buy a property in a rural part of the country. The loans are backed by the USDA against default, so lenders are willing to offer credit to lower FICO score borrowers.

The USDA itself does not set a minimum credit score, but most USDA-approved lenders want to see a score of 640. This is the minimum score you need to qualify for automatic approval via the Guaranteed Underwriting System used by USDA. (USDA)

Most USDA lenders require a minimum credit score of 640 is often required, although exceptions may apply if the lender conducts a manual underwriting process. You can qualify with a score below 640, but you will need to have manual underwriting performed. Even if you have no credit score at all, you might still qualify, but you will need to meet additional income and financial requirements. USDA loans aim to support rural homeownership.

USDA loans offer low closing costs, 100% financing and low interest rates. Learn more about government grants for first time home buyers.

The Ready Buyer HomePath loan program is offered by Fannie Mae and is intended for first time home buyers. It requires only a down payment of 3%, and that 3% can come back to you to cover closing costs if you take a $75 online training program about home ownership and mortgages.

Some of the many benefits of the Ready Buyer HomePath loan program are:

- You should have a credit score of 640 or higher to qualify. If your score is well below 640, you may want to consider an FHA loan instead.

- 3% cash back to cover your closing costs

- No private mortgage insurance is required

- You do not need a home appraisal

- Condo and Co-op approvals may be waived in some situations

- You can get both fixed rate and adjustable rate mortgages

To qualify for this program, you will need to show that you have stable employment, meaning two years with the same employer; proof of income; W-2s and tax returns; no more than one late payment in the past 12 months; and only HUD homes that are listed on the HomePath site are eligible for purchase. (Homepath)

An FHA 203k loan is designed to pair with a standard FHA mortgage to cover renovation costs on a property that needs repairs before it can be occupied. This loan wraps purchase and renovation costs into one low interest rate mortgage.

With this loan, you have the option of getting a streamlined loan that allows you to make up to $35,000 in repairs, no matter the value of the home. If you need to make bigger repairs, you want a standard FHA 203k loan.

To qualify for an FHA 203k loan, you need to meet these standards:

- Credit score generally needs to be between 620 and 640, depending upon the FHA-approved lender.

- Maximum debt to income should be between 41% to 45%.

- Down payment of 3.5% is required.

- The loan amount that includes the purchase and renovation costs has to be below the maximum limit on FHA loans for your area.

- You must occupy the home you are renovating (this program is NOT for investors).

The major difference with the 203k loan is that you need to qualify not just for the purchase price of the home, but for the cost of the renovations. So, if you want to buy a home with an FHA loan worth $150,000, you will also need to qualify for the $25,000 in repairs you want to do, for a total loan of $175,000.

Fannie Mae loans are conventional mortgages that are not directly backed by the US government, so the credit score requirements are usually higher than for government-backed programs such as FHA and USDA. To get the best rates with Fannie Mae, you will need to have a credit score above 740. (Fannie Mae)

However, it is possible to qualify for a Fannie Mae loan with minimum credit score requirements of 620, but you can expect to need a down payment of 20% or more. You can get a Fannie Mae loan with a down payment as low as 3%, but your interest rate may be higher.

Many first time buyers with lower credit scores may find that their best option is to choose an FHA mortgage with a lower credit score requirement and low down payment.

Freddie Mac loans are also conventional loans that are not directly backed by the government, so higher credit scores are often required. As with Fannie Mae loans, you will need a credit score above 740 for the best rates, but it is possible to get a Freddie Mac loan with a 620 to 640 credit score with a 3% down payment. (Freddie Mac)

Both Freddie Mac and Freddie Mae now allow you to even avoid paying PMI with a lower than 20% down payment. You would need to pay a slightly higher interest rate, but this can be a good program for some first time buyers.

A jumbo loan exceeds the conforming loan limits that have been set by the US government. It is a mortgage that does not fit guidelines established by Fannie Mae, Freddie Mac or FHA. For most counties in the US, the conforming loan limit for a single family home in 2025 was $453,100, but some higher cost areas have higher limits. For example, in Hawaii, the conforming limit is $721,000.

Because the loans are larger, you can expect a higher credit score to qualify. There are some limited jumbo loan programs with higher rates available to borrowers with a 500 credit score, but you would need a big down payment and ample cash reserves. For regular jumbo loans, expect at least a 680 credit score, and 700 or 720 is required for the best rates. (US News)

HARP Loans

The Home Affordable Refinance Program or HARP was started in March 2009 by the US government to help people who were underwater on their homes to refinance their mortgages.

There is no minimum credit score to qualify for HARP, but there are other strict requirements that you need to be aware of:

- Your mortgage must be backed by Fannie Mae or Freddie Mac.

- The mortgage needs to have been sold to Fannie or Freddie by May 31, 2009.

- Borrowers need to be current on their loan payments with no late payments more than 30 days late in the last six months.

This program is designed for people who are current on their payments, but owe more than their home is worth. Even if your credit score is low, you still may be able to qualify. The loan could be refinanced to the current value of the property so that you can once again build equity in your home. (HARP)

Average Credit Scores in the United States

Your credit score will usually dictate which mortgage loan program is the best for you. Generally credit scores break down as follows:

- 720+: Excellent

- 660-719: Good

- 620-659: Fair

- 619 or below: Poor

The average credit score in the US in 2023 is 704. But if your score is much lower, you still have many options to buy a home. Check with your mortgage lender to determine which of the above programs are a good fit for you based upon your credit score and other criteria. (Elite Personal Finance) We hope you have learned what credit score is needed to buy a home this year.

FAQs for Credit Scores for Home Loans

Can I Buy a Home with a 500 Credit Score?

Yes, but options are limited. FHA loans allow credit scores as low as 500, but you must make a 10% down payment. Some non-QM (Non-Qualified Mortgage) lenders offer alternative financing, but expect higher interest rates and stricter terms. Improving your credit score, saving for a larger down payment, or finding a co-signer can increase your chances of approval.

Can You Purchase a Home with a 550 Credit Score?

Yes, but financing options are limited. FHA loans may approve a 550 credit score with a 10% down payment, and some subprime or non-QM lenders might offer financing. However, you’ll likely face higher interest rates and stricter requirements. To improve your chances, consider paying down debt, increasing savings, and improving your credit score before applying for a mortgage.

Which Credit Score Do Lenders Use for Home Loans?

Most mortgage lenders use the FICO Score 2, 4, or 5, which are industry-specific mortgage scores. When applying for a home loan, lenders pull scores from all three major credit bureaus (Experian, Equifax, and TransUnion) and use the middle score for qualification. If applying jointly, lenders use the lower middle score between both applicants. Maintaining a strong credit profile can improve approval chances.

Learn More About Credit Score Rules and Niche Loan Products on RefiGuide.org

- Poor Credit Mortgage Help

- Home Equity Loans with Bad Credit

- First Time Home Buyer with Bad Credit

- FHA Home Loans with Bad Credit Scores

- How Does a Cash Out Refinance Work

References

- VA Loan Overview. (n.d.)

- Freddie Mac Overview. (n.d.)

- Fannie Mae Mortgage Products. (n.d.)

- Average Credit Score. (2019).